XaaS pricing (e.g. SaaS, PaaS) - New product

Overview

This guide covers XaaS pricing. There are many different types of these. Common ones are:

SaaS - Software as a Service.

RaaS - Robots as a Service.

IaaS - Infrastructure as a Service.

The guide will focus on SaaS examples.

Introducing pricing

Pricing is a high-impact growth lever. Getting it right will increase your revenue. This guide is designed to create product-level pricing. It is important to differentiate between these two pricing aspects:

A “core” revenue model

The first step is to select a core revenue model for your pricing. Here are some SaaS product examples:

Subscription Revenue Model -

Customers pay recurring fees at regular intervals for continued access.

Revenue is predictable and recurring.

Example: Netflix, Salesforce base subscription.

Usage-Based Revenue Model

Customers pay based on their actual consumption/usage.

Revenue scales directly with customer usage.

Example: AWS, Twilio API calls.

Hybrid Revenue Model

Combines subscription + usage-based elements.

Base recurring fee + variable consumption charges.

Example: Subscription with usage overages.

See the “Revenue and Pricing” tab for full descriptions of these.

Pricing components

See the “Revenue and Pricing” tab for full descriptions of these.

Pricing model - the structure of how prices are constructed and charged (e.g., subscription, usage-based, tiered, per-seat).

Pricing strategy - the approach or tactics you use to achieve your objectives (e.g., penetration pricing, skim pricing).

Pricing process

To create your pricing, you will follow this process:

Create a business model

Before you start working on pricing, you should have a business model for your new product. Should you require it, a canvas and process are provided here. An important part of creating your business is defining who your target customer is. The Ideal Customer Profile (ICP) is where you generate the most profit and have sustainable growth. If you wish to run this as a standalone activity, you can use either of these links:

B2C Customer Persona Canvas - Where you sell directly to customers.

B2B Company Profile Canvas - Where you sell to organisations.

Identify competitors

Identify your direct and replacement competitors:

Direct - those competing for sales with similar products and target customers.

Replacement - those with alternative solutions. Very important, where there is an emerging superior solution that will replace yours.

These are explained in full here. Include these in the competitor analysis grid below.

High-level competitor pricing analysis

Gather an overview of your competitors before making any decisions about your pricing model and strategy. To understand pricing models and strategies, use the tabs below.

Win/Loss/Churn Pricing Analysis

Before you copy your competitors’ pricing model and strategies, consider that they may not be optimised. You are looking for specific weaknesses with their model and strategy:

Loss - What factors in your competitors’ pricing are putting them off purchasing?

Churn - Are customers leaving your competitors because of pricing?

Sources for this analysis:

Review Aggregators (G2, Capterra, Trustpilot): Filter these reviews by 2, 3, or 4 stars. Users in this range often like the product but may complain about the "value for money" or the "sudden price jump."

Reddit & other forums - Search for

"[Competitor Name] vs"or"[Competitor Name] expensive". Threads like "Alternatives to [Competitor]" for pricing-specific churn and loss reasons.Social Media (X/LinkedIn) - Search for the competitor's name + "pricing" or "billing."

Competitor "Pricing" Pages (FAQs) - Look at the questions they address. If they have a long FAQ about "What happens if I go over my limit?", it’s a sign that their customers struggle with billing predictability.

This information should be aggregated into key reasons with strong market signals. Treat these as strong evidence where:

Volume - Look for the same pricing complaint across multiple platforms (e.g., Reddit AND G2).

Alternative - When you search in forums for the following terms, and the reasons that appear in the top search results. This gives the strongest market signals:

Moving from [Competitor] to

[Competitor] + pricing + worth it

Is there a cheaper version of [Competitor]

Cancel [Competitor] because

Review Sorting - Sort reviews by "Most Helpful." If a review complaining about the "Per-Seat cost" has 50 upvotes, that is a verified market signal.

| Pricing Overview | Competitor A | Competitor B | Competitor C |

|---|---|---|---|

| Competitor Type | Direct | Direct | Replacement |

| Revenue Model How does money flow and when? The strategic decision everything else hangs off. |

Subscription: Recurring monthly or annual billing. Annual contracts incentivised with ~17% discount. | Subscription + Services: Recurring subscription plus one-off paid onboarding and implementation packages. | Pay-Per-Use: Customers pay based on consumption each billing cycle. No fixed recurring commitment. |

| Pricing Model What is the unit of value they charge for? Dependent on the revenue model above. |

Per Seat: Each user is a billable unit. Price per user varies by tier. Cost scales linearly with team size. | Flat-Rate Tiered: Fixed price per tier. Features and capacity define each tier, not headcount. | Metered Usage: Charges per unit of consumption (e.g., per 1,000 API calls, per GB stored). Costs scale continuously with usage. |

| Pricing Implementation / Package The actual numbers, tiers, and packaging. The most granular level. |

Free: £0 (up to 5 users) Pro: £12/user/mo Business: £24/user/mo Enterprise: Contact sales |

Starter: £79/mo Professional: £199/mo Enterprise: £499/mo Custom: Contact sales |

Free Tier: First 10,000 requests/mo free Pay-as-you-go: Metered rates beyond free allowance Committed Use: Volume discounts with pre-paid commitment |

| Restrictive Limits (Upgrade Triggers) | User Count: Primary bottleneck forcing higher tiers. | Admin/Security Gating: Features like SSO act as the wall. | Volume/Capacity: Hard limits on data or API calls. |

| Dominant Pricing Strategy | Expansion (Land and Expand) | Premium / Margin-Focused | Penetration |

| Minimum Product Price (The absolute minimum to start) | £0 (Freemium): Zero financial barrier for entry. | £250/mo: Higher barrier, targets established teams. | Pay-as-you-go: No fixed floor, based on initial usage. |

| Entry Point Generosity | High – low friction self-serve with rich free features. | Medium – sales-assisted, no free tier available. | Very high – minimal constraints on initial usage. |

| Verified Pricing Market Signals (High-Confidence Evidence Only) | |||

| Wins due to pricing | Strong sentiment regarding value for small setups and startups. | "Sweet spot" for medium-sized companies needing professional features. | "Incredible value" and significantly cheaper than alternatives. |

| Losses due to pricing | Prospects decline at higher tiers. There is a lack of support or features for the price. | High friction at entry. It is too expensive for small prospects to start. | Insufficient Information: No strong market signals. |

| Churn due to pricing | "Outgrown" signal. It is too expensive at the top for what is provided. | Resentful retention. Customers feel "locked in" by configuration effort. | Insufficient Information: No statistically significant data. |

| Extended Pricing Intelligence (Where Available) | |||

| Estimated ARPU Average revenue per user/account — may require estimation |

Estimated: ~£180/yr per user, blended across free and paid. Source: public filings and third-party estimates. | Estimated: ~£4,800/yr per account. Higher floor but narrower customer base. Enterprise-weighted. | Unknown. No public data available. Wide variance likely given consumption model. |

| Discounts & Incentives Startup programmes, volume breaks, promotional pricing |

Startup programme: 50% off year one. Nonprofit discount available on request. Volume pricing for 100+ seats. | Unknown. No publicly visible discount programmes. Likely negotiated case-by-case at Enterprise level. | No formal discounts. Committed Use plans function as the volume incentive. Open-source tier available for developers. |

| Contract Flexibility Cancellation, downgrade, and lock-in terms |

Month-to-month on all tiers. Downgrade freely between tiers. Annual contracts non-refundable once billed. | Partially known. Enterprise requires 12-month minimum. Starter/Professional appear monthly cancellable. No public downgrade policy found. | No contract required. Usage can stop at any time. Committed Use plans carry minimum 12-month term. |

| Pricing Page Approach How their pricing page is structured and what it emphasises |

Comparison table layout with feature rows and checkmarks. "Most Popular" highlight on mid-tier. Free tier shown first to anchor low. | Three-card layout. Enterprise card is largest. Emphasis on "Talk to Sales" CTA. Feature comparison below the fold. | Calculator-first design. User inputs expected usage, sees estimated monthly cost. Published rate card for each metric. |

Market trends

Broader patterns in your industry, like shifting from per-user to usage-based pricing, typical discount rates, annual vs monthly preferences, or changing willingness to pay as the market matures. This helps you stay relevant and adapt before you fall behind.

Example 1 : Paying only for active users.

Only paying for active users. In the market, there has been a greater focus on costs. This drove organisations to question the value of per-seat subscriptions, particularly when it came to paying for non-active users. Although you could get detailed reporting to identify them, Slack introduced a new charging model. They would only charge for active users and automatically credit you back for inactive ones (not logged in for 14+ days). After this, customers started expecting it elsewhere. This set a new market expectation for fairness in SaaS pricing that spread beyond Slack's direct competitors.

Example 2: AI as a chargeable add-on.

In the market, the AI boom created new costs for SaaS companies. Many vendors found they couldn't afford to include AI capabilities in existing subscription tiers without drastically raising prices across the board or taking major margin hits. This drove them to split out AI features as separate paid add-ons. Microsoft led this with Copilot pricing (£30/user/month on top of Microsoft 365), followed by GitHub Copilot, Salesforce Einstein GPT, and Notion AI. While some customers resisted the extra charge, enough saw the value and paid for the separate AI pricing, making it an accepted pattern. This demonstrates that when new technology creates genuine cost pressure for vendors, customers will accept unbundling if the value is clear, rather than expecting vendors to absorb those costs into base pricing.

Select your core revenue model

The first step is to select a core revenue model for your pricing. These are foundational choices that you must consider. You won’t set your prices yet. Supplementary offerings, like a separately charged project for product configuration, can be considered later. Eventually, you will use your core revenue model choice and build out your pricing. These could be:

A single revenue model - For example, subscription to a product. After you decide on this model, you set a price where every customer pays £20 a month for full access to the product.

Hybrid -At the end of this exercise, you may decide that a combination of these is important. For example, (Subscription to product) every customer pays £20 a month for access to the full product, and (Usage-based) you decide to charge every customer £0.10 per GB of data storage. The examples at the bottom of the selection grid show some common SaaS combinations and the reasoning behind their selection.

There are two additional considerations that are not revenue models but are important foundational choices:

Freemium - You decide to offer customers the product free for life with limitations. Offering a free trial is another option, but it has less impact and is not included here.

Tiered subscription pricing - For example, you decide to introduce basic/pro/enterprise pricing tiers as you have different target customer groups. Tiers will significantly affect how your pricing will work.

See the “Revenue and Pricing” tab for full descriptions of the revenue models. When asking customer-related questions in the grid, use your competitor research or talk to customers yourself.

| Your Situation | Importance (H/M/L) |

|---|---|

| Usage-Based | |

| One or more usage attributes that meet these three conditions: (1) costs scale directly with consumption, (2) consumption varies significantly between customers, AND (3) these costs are high enough to significantly impact profitability | ⚠️ IF YES YOU MUST USE THIS MODEL |

| Customers resist upfront commitments and prefer paying only for what they consume | |

| You want revenue to expand automatically as customers use more | |

| Per-User | |

| You want pricing that's simple and predictable for customers to calculate | |

| Your customer segments vary significantly in team size (from individuals to large organisations) | |

| You want revenue to grow automatically as customer teams expand | |

| Transaction-Based Commission | |

| Your platform facilitates transactions between parties (e.g. eBay connecting buyers and sellers) OR processes payments/transactions for customers (e.g. Stripe) | |

| You want to eliminate barriers to entry - customers can start for free and only pay when transactions occur | |

| Revenue scales directly with transaction volume on your platform | |

| Subscription to Product | |

| Customers use your product regularly enough to justify a recurring subscription payment | |

| Customers value the cost predictability of a subscription over pay-per-use flexibility | |

| You want to create an ongoing relationship beyond single transactions, delivering more predictable revenue and opportunities to increase Customer Lifetime Value (CLV) through better targeted upselling and cross-selling | |

| Tiered Subscription | |

| Your customer segments have distinctly different needs - for example, some need only basic functionality while others require advanced capabilities | |

| You've built genuinely differentiated feature sets or offer service levels that deliver progressively more value to address these different needs | |

| Customers have significantly different willingness-to-pay based on their needs with some willing to pay substantially more | |

| Freemium (Free Product for Life) | |

| You're targeting a large addressable market where customers are much more likely to purchase after trying the product with ongoing free access - this enables broader reach and increases the chances of driving viral growth | |

| You have natural growth built into the product, coupled with clear triggers that motivate free users to upgrade (usage limits, feature needs, team growth) | |

| You can support free users economically (including the cost of onboarding), either through very low costs or having capital to invest with strong conversion economics that justify the investment | |

| Common SaaS Combinations (Hybrid Models) | |

| These examples show which revenue models apply for common SaaS scenarios. | |

| Infrastructure costs scale with usage AND customers want predictable base access | Usage-Based + Subscription to Product |

| Team collaboration tool with variable resource costs | Per-User + Usage-Based |

| SaaS product requiring paid implementation or onboarding | Subscription to Product + Professional Services |

| Serving SMBs to Enterprise with varying feature needs and usage patterns | Per-User + Tiered Subscription + Usage-Based |

| Large addressable market with low cost-to-serve and clear upgrade paths | Freemium + Tiered Subscription |

| Marketplace or platform facilitating transactions between parties | Transaction-Based Commission + Subscription to Product |

Build out pricing model

Use the information you gathered from competitors, along with the advice in the pricing models tab below, to select your model.

Customer purchase patterns and pricing testing

How your customers actually buy will not be available for a new product. This includes which plans they choose, when they upgrade/downgrade, what features drive conversions, seasonal buying cycles, and price sensitivity at different tiers. Your initial pricing will be based on assumptions and should be treated as a test. When you receive real data, you can optimise packaging and pricing based on real behaviour.

How customers consume value

How your costs scale

What customers can understand and budget for

https://www.salesforce.com/blog/pricing-models/

The "Double the Limit" Test: If the competitor doubled their usage limits or added two more seats for the same price, would the customer complaints stop?

If Yes: The model (e.g., Per-User) is fine, but their execution (the price point) is poor. You can win by using the same model with better "generosity" or more logical tiers.

If No: The model is the problem. Customers hate the way they are being charged (e.g., they hate paying for seats when only one person uses the tool). You should pivot to a different model entirely, like Usage-Based

Create pricing model in full - Determine customer willingness to pay (ceiling price)

Pricing

Tiered subscription pricing

This section describes the process to create the pricing model. It is based on the following:

Pricing tiers - these are the various priced plans, such as beginner, intermediate and expert that are sold on a subscription basis, i.e. a monthly payment cadence

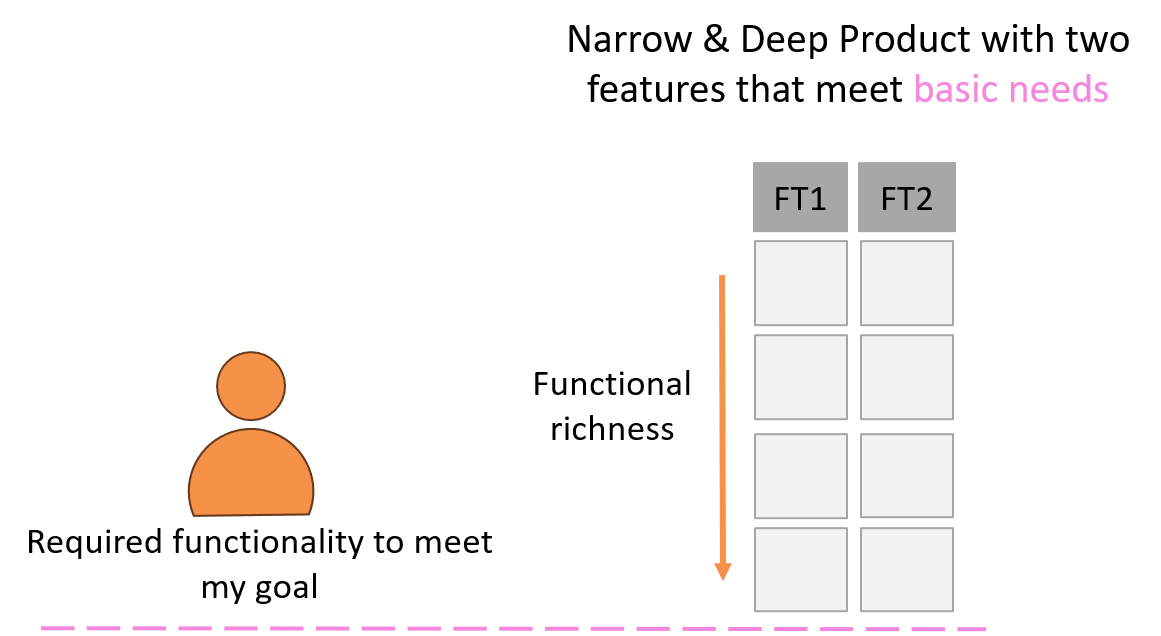

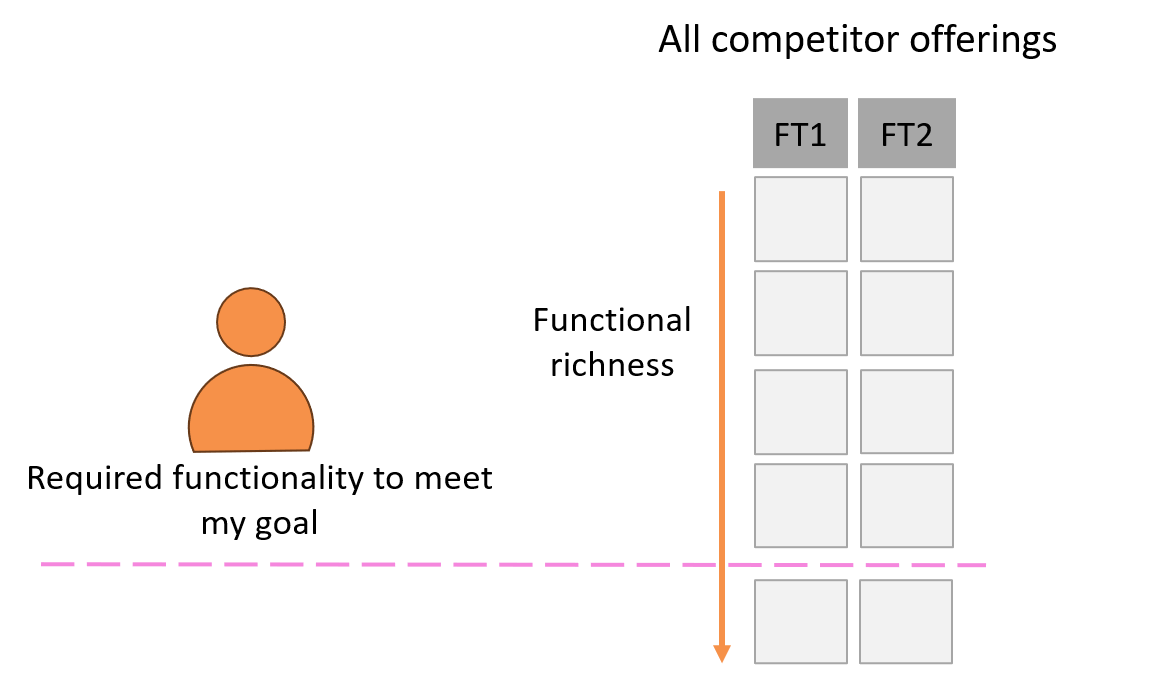

Core product features - all customers receive these, the product must contain enough functionality to be:

Useful - solve a big enough problem for a customer.

Competitive - at least match the functionality that all competitors have.

Usage limits within the tiers - Optionally, you may limit some attributes, like the number of users, to:

Drive customers to more expensive tiers.

Control your costs, particularly of high-usage customers.

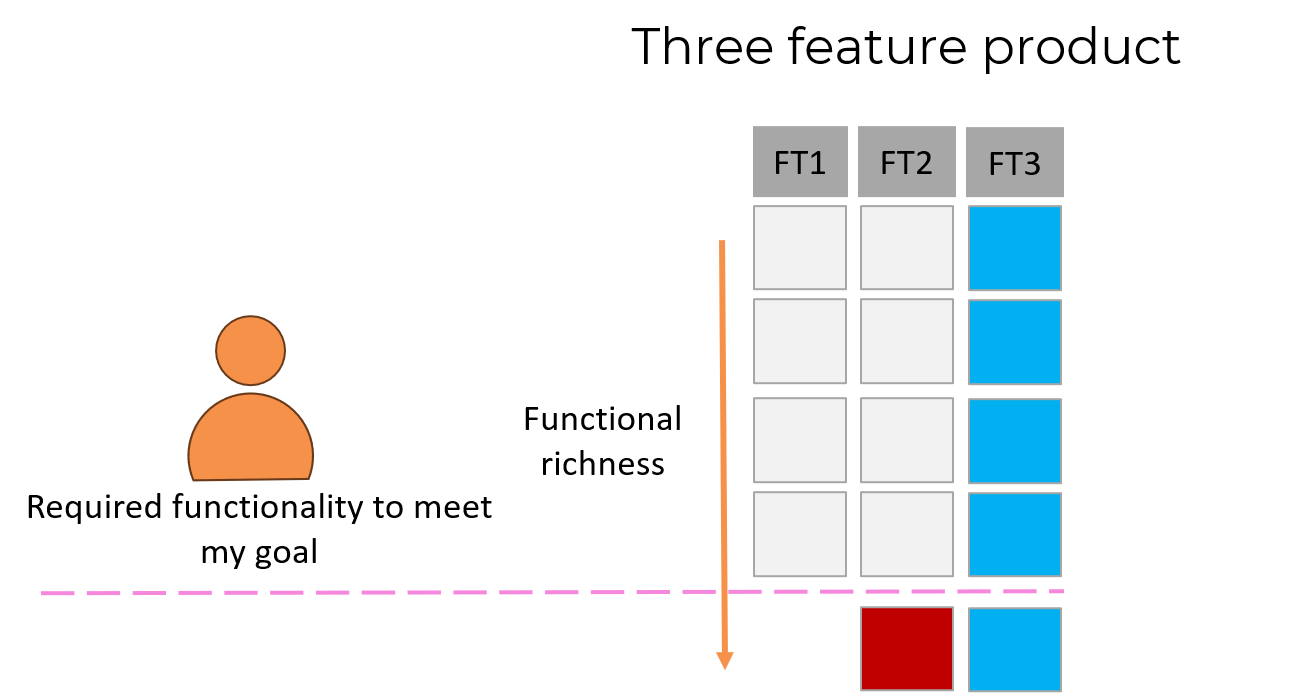

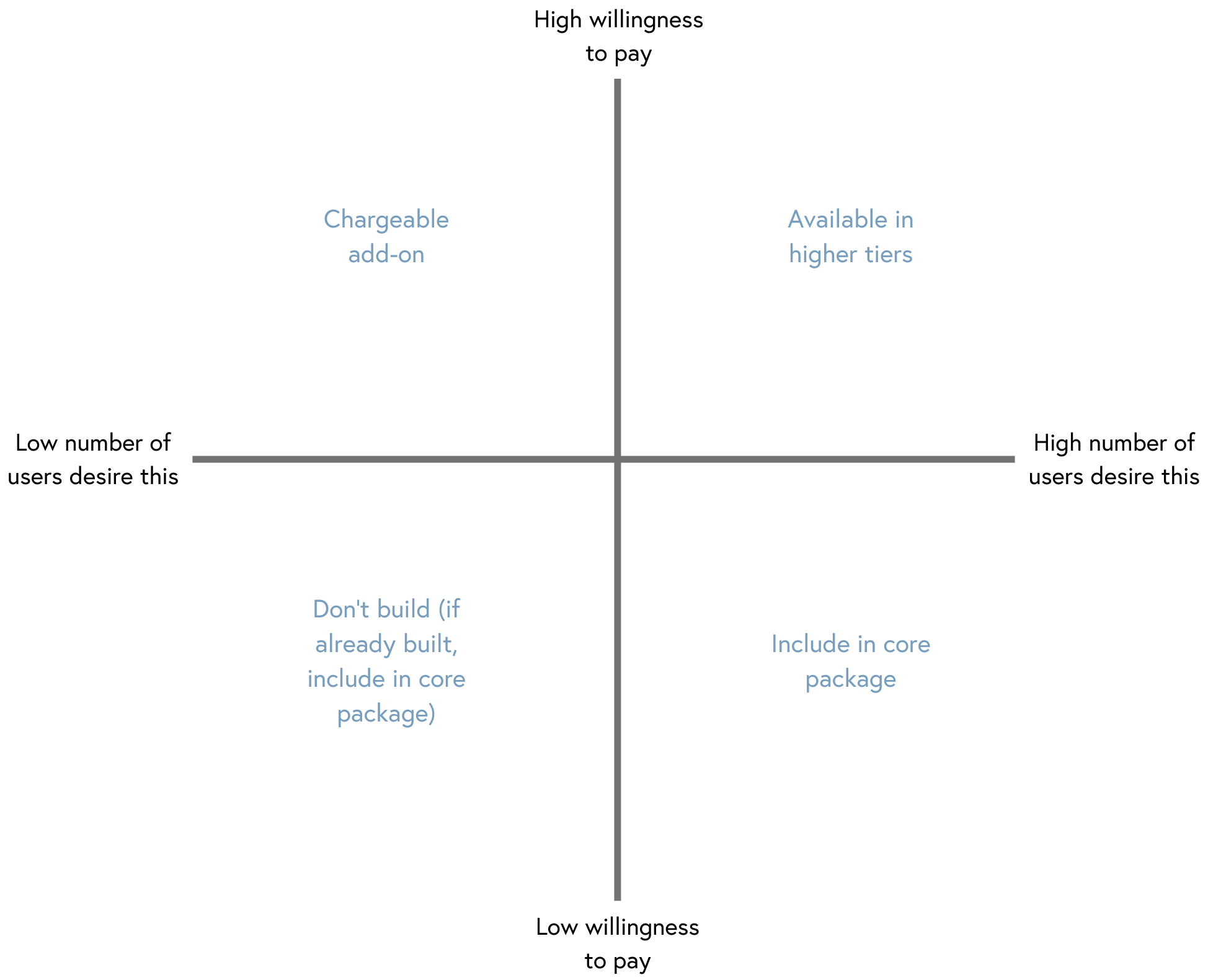

Add-on features - these are the features that have their own pricing:

Available as an additional cost within all/some tiers.

To improve value, they may be included in higher tiers for free.

Set up charge - Additional charge to cover set up. Especially relevant where the product has a complex configuration or data migration requirements:

Offer a setup service as an optional extra.

Offer free setup for higher price tiers.

Introducing pricing tiers

Pricing tiers are designed to increase revenue. There are several benefits to using these:

Different usage - A single high price may attract enterprise companies but deter smaller companies with lower budgets and lower usage requirements. Conversely, a single low price leaves money on the table, as enterprise companies would be willing to pay more, thereby reducing potential revenue.

Different customer needs - Customers have varying needs and want to pay only for what they use. For example, an enterprise may require a custom integration with its ERP system, while a small business needs only basic features. Multiple pricing tiers allow you to target these different customer segments and maximise revenue.

Scalability and growth - Customers can start with a lower tier and upgrade as their needs grow. This will help you avoid low-cost competitors capturing these customers. Switching products can be painful due to contract negotiations, configuration, training and data migration. Additionally, this gives your low-cost competitors time to expand their product offerings and retain these customers.

Psychological anchoring - In the case where you are targeting one customer segment with similar usage requirements. You can use multiple tiers to create reference points that make mid-tier options appear better value and guide customers towards them. For example, making your lowest-priced tier poor value, both in usage limits and functionality.

A three to five-tier pricing model is popular. Below we see an example of three tiers. This makes it easier for customers to understand, and you can clearly explain to them why the tier exists. Tiers must have strong value differentiation. More tiers can make this harder and confuse customers:

Tier 1 - Basic - Simple functionality aimed at small companies.

Tier 2 - Advanced - More comprehensive functionality that covers some more advanced use cases.

Tier 3 - Enterprise - Full functionality with premium support, advanced integrations, and dedicated resources.

Creating your pricing tiers

This process will help you create your own tiers.

Map competitors’ pricing tiers - Create a high-level overview of competitor pricing tiers.

Analyse competitor pricing tiers - Perform a detailed analysis of competitor:

Tier usage limits.

Features provided in each pricing tier.

Determine competitor pricing strategy - Identify the strategy(s) that your competitor is using.

Create your own pricing tiers - Build a competitive offering.

Map competitors’ pricing tiers

The grid below compares competitors' pricing tiers at a high level. The process to create this is provided below the grid.

Sales motion

Sales motion in the grid should be one of the following approaches:

Self-service (product-led, no sales involvement).

Product-led sales (PLS) or Product-assisted sales (starts self-service, sales can assist).

Sales-assisted (sales involvement during buying process).

Sales-led (sales drives the process).

| Tier Level | Competitor A (Market Leader) | Competitor B (Fast Growing) | Competitor C (New Entrant) |

|---|---|---|---|

| FREEMIUM TIER | |||

| Price | Free | Free | No free tier |

| Target Customer | Individual users | Individual users | - |

| Their Ideal Customer Profile | No | No | - |

| Customer-Facing Description / Interpreted Positioning | Try before you buy with full feature access | Get started free with essential features | - |

| Free Trial | N/A - Free tier | N/A - Free tier | - |

| Support Level | Community support only | Email support | - |

| Conversion Strategy | 30-day trial of Pro features | Feature-gated from start | - |

| Sales Motion | Self-service | Self-service | - |

| BASIC / STARTER TIER | |||

| Price | £250pm | £350pm | £299pm |

| Target Customer | Small teams | Small teams | Small teams |

| Their Ideal Customer Profile | No | No | No |

| Customer-Facing Description / Interpreted Positioning | Essential features for small teams getting started | Complete solution for fast-growing startups | Everything you need to get up and running quickly |

| Free Trial | 14 days | 30 days | 14 days |

| Support Level | Email support | Email + chat support | Email support |

| Annual Discount | 20% (£2,400 annual) | 10% (£3,780 annual) | 15% (£3,050 annual) |

| Sales Motion | Self-service | Self-service | Self-service |

| PROFESSIONAL / GROWTH TIER | |||

| Price | £900pm | £1,200pm | £799pm |

| Target Customer | Mid-sized businesses | Mid-sized businesses | Mid-sized businesses |

| Their Ideal Customer Profile | Yes | Yes | Yes |

| Customer-Facing Description / Interpreted Positioning | Advanced capabilities for established businesses with proven reliability | Cutting-edge features and scalability for high-growth companies | Professional-grade features at competitive pricing for growing teams |

| Free Trial | 14 days | 30 days | 14 days |

| Support Level | Email + phone support | Priority email + phone + chat support | Email + phone support |

| Annual Discount | 20% (£8,640 annual) | 15% (£12,240 annual) | 15% (£8,159 annual) |

| Sales Motion | Product-assisted sales | Product-assisted sales | Product-assisted sales |

| ENTERPRISE TIER | |||

| Price | Custom (£5,000pm+ typical) | £2,500pm base + custom additions | £1,999pm fixed |

| Target Customer | Large enterprises | Large enterprises | Large enterprises |

| Their Ideal Customer Profile | No | No | No |

| Customer-Facing Description / Interpreted Positioning | Enterprise-grade security, support and customization for global organizations | Scalable platform with dedicated support for enterprise needs | Enterprise features with simplified pricing for mid-market companies |

| Free Trial | Custom POC/pilot program | 30 days with onboarding | 14 days |

| Support Level | Dedicated account manager + 24/7 support + SLA | Dedicated success manager + priority support | Email + phone + priority queue |

| Annual Discount | Negotiable (typically 15-25%) | Custom based on commitment | 10% (£21,589 annual) |

| Sales Motion | Sales-led - Enterprise sales team, RFP process | Sales-led - Solution architects + sales team | Sales-assisted - Optional enterprise sales support |

Grid creation process

The mapping rule: Match tiers by TARGET CUSTOMER, not by price or tier name.

Competitor A might offer a "Professional" tier at £900 for mid-sized businesses, while Competitor B offers a "Growth" tier at £1,200 for the same segment. Even though they have different names and different prices, these tiers belong in the same row of the grid because they compete for the same customer segment.

Identify each competitor's Ideal Customer Profile (ICP) tier first - This is the tier where they have "Yes" in the "Their Ideal Customer Profile" row. This is their primary focus and where they compete most directly with you.

Match ICP tiers together - All competitors' ICP tiers should map to each other (appear in the same tier section of the grid). For example:

Competitor A's ICP = Professional tier (mid-sized businesses).

Competitor B's ICP = Growth tier (mid-sized businesses).

Competitor C's ICP = Business tier (mid-sized businesses).

These all map together, even though they have different names.

Then map the other tiers - Look at who each tier targets. These non-ICP tiers are secondary. If a tier doesn’t clearly map to another competitor, that’s fine, it is not a priority for the grid. In the grid:

All tiers targeting "small teams" map together.

All tiers targeting "individual users" map together.

All tiers targeting "large enterprises" map together.

Common mistakes to avoid:

Don't map by tier name - "Basic" from one competitor might target individuals, while "Basic" from another targets small teams.

Don't map by price alone - A £300/month tier targeting enterprises is NOT the same as a £300/month tier targeting small teams.

Don't map by features - Features differ, but if they target the same customer segment, they belong together.

Per seat/usage discount pricing (no-tiers):

Some competitors may operate without tiers, and you’d still like to compare value. This is what a customer is trying to do in the same situation. Per seat/usage are still a restriction even though they don’t sit in pricing tiers. Using seats as an example:

Add a column in your grid for the competitor.

At the average price of your mapped tiers (see the grid below), you should work out how many seats that will give you. For example, at £300, the price is £10 per seat, so you get 30 seats. Record the “price per seat” as well as the number of seats you would get at the average price.

Restrictive limits / key usage differentiators

Restrictive limits are the most important. You could be very generous across multiple factors, but one serious limitation will stop that tier from being good value. In fact, some of the very generous limits may be irrelevant. For example, a data storage amount where almost no users go above 2GB, but your competitors offer 50gb. Some inexperienced customers may fall for this, but it really doesn’t matter. When used in this way, they are known as “perception differentiators”. Consider including these if marketing is pushing them. They are important to record, as you can easily equal or offer even higher amounts with no cost.

Key usage differentiators are where a competitor offers genuine value. If a restrictive limit is in place, these may not, in reality, be that important.

Do not include a usage limit as a comparison factor when it is set well above realistic customer usage and does not influence pricing tier selection.

Analysing competitor usage limits

This grid covers usage limits across the tiers.

| Tier / Metric | Competitor A (Market Leader) | Competitor B (Fast Growing) | Competitor C (New Entrant) |

|---|---|---|---|

| FREEMIUM TIER | |||

| Price | Free | Free | - |

| Max Users / Seats | 1 | 1 | - |

| Reports / Dashboards | 5 (overage: £0.10 per extra report, max 10 total) | 5 (overage: £0.05 per extra report, max 20 total) | - |

| Data Storage / Records | 1 GB | 50 GB | - |

| Included API / Connector Calls | 1,000 | 10,000 | - |

| Exports / Downloads | 10 files/month | 20 files/month | - |

| Integrations / Connectors | 3 | 5 | - |

| Restrictive Limits (Upgrade Triggers) | 1 GB storage severely limits data exploration; reports capped at 10 even with overage | 5 reports may limit dashboard experimentation | - |

| Key Usage Differentiators | Minimal offering designed to drive quick upgrades | 50x storage and 10x API allowance vs Competitor A encourages deeper product engagement | - |

| BASIC / STARTER TIER | |||

| Price | £250/month | £350/month | £299/month |

| Max Users / Seats | Up to 5 | Up to 10 | Up to 5 |

| Reports / Dashboards | 10 (overage: £0.10 per extra report, max 20 total) | 20 | 10 (overage: £0.10 per extra report, max 20 total) |

| Data Storage / Records | 50 GB | 100 GB | 50 GB |

| Included API / Connector Calls | 10,000 | Unlimited | 10,000 |

| Exports / Downloads | 50 files/month | Unlimited | 50 files/month |

| Integrations / Connectors | 5 | 10 | 5 |

| Restrictive Limits (Upgrade Triggers) | 5 seat limit set below typical small team size (7-10 people); 10 reports (max 20 with overage) deliberately constrains dashboard usage | 10 integrations may limit complex multi-tool workflows | 5 seat limit set below typical small team size (7-10 people); 10 reports (max 20 with overage) deliberately constrains dashboard usage |

| Key Usage Differentiators | Lowest price point | Unlimited API and exports; 2x seats vs competitors; 40% price premium | 20% higher price than Competitor A with equivalent limits |

| PROFESSIONAL / GROWTH TIER ⭐ (ICP TIER FOR ALL COMPETITORS) | |||

| Price | £900/month | £1,200/month | £799/month |

| Max Users / Seats | Up to 50 | 50–100 | Up to 50 |

| Reports / Dashboards | 50 (overage: £0.05 per extra report, max 100 total) | Unlimited | 50 (overage: £0.05 per extra report, max 100 total) |

| Data Storage / Records | 500 GB | 1 TB | 500 GB |

| Included API / Connector Calls | 100,000 | Unlimited | 100,000 |

| Exports / Downloads | Unlimited | Unlimited | Unlimited |

| Integrations / Connectors | 50 | Unlimited | 50 |

| Restrictive Limits (Upgrade Triggers) | 50 seat cap set at lower end of mid-sized business range (50-250 employees); 50 reports (max 100 with overage) may limit teams with extensive dashboard needs | None | 50 seat cap set at lower end of mid-sized business range (50-250 employees); 50 reports (max 100 with overage) may limit teams with extensive dashboard needs |

| Key Usage Differentiators | Competitive pricing with overage flexibility on reports | Unlimited reports, API, and integrations; 2x storage; 33% price premium vs Competitor A | 11% cheaper than Competitor A, 33% cheaper than Competitor B |

| ENTERPRISE TIER | |||

| Price | £5,000/month base | £2,500/month base | £1,999/month fixed |

| Max Users / Seats | Up to 200 (£50 per additional seat) | Up to 150 (£30 per additional seat) | Up to 100 (£20 per additional seat) |

| Reports / Dashboards | Unlimited | Unlimited | 200 (£0.02 per extra report) |

| Data Storage / Records | 5 TB (£2 per additional GB) | 3 TB (£1.50 per additional GB) | 2 TB (£1 per additional GB) |

| Included API / Connector Calls | 10 million (£0.50 per 10K additional calls) | 5 million (£0.30 per 10K additional calls) | 1 million (£0.20 per 10K additional calls) |

| Exports / Downloads | Unlimited | Unlimited | Unlimited |

| Integrations / Connectors | Unlimited | Unlimited | Unlimited |

| Restrictive Limits (Upgrade Triggers) | 200 seat limit requires overage pricing for larger organizations (500+ employees) | 150 seat limit requires overage pricing for larger organizations (500+ employees) | 100 seat limit may be restrictive for true enterprise scale; 200 report cap unusual at this tier |

| Key Usage Differentiators | Highest base limits (200 seats, 5TB, 10M API calls); premium overage pricing reflects enterprise positioning | Middle-tier base limits; most competitive overage rates (£30/seat, £1.50/GB) | Lowest base limits and fixed pricing suggests targeting smaller "enterprise" customers; most competitive overage rates |

| Pricing Strategy & Positioning | Highest entry point (£5,000) targets true enterprise budgets; generous base limits reduce need for overages | Mid-point pricing (£2,500) balances accessibility with enterprise credibility; lower base limits likely drive overage revenue | Fixed pricing (£1,999) simplifies procurement; "enterprise lite" positioning for mid-market customers |

Analysing features

This grid lists the features available at each tier. The analysis can become overwhelming if competitors’ feature lists are reproduced in full, particularly where they include basic, expected functionality. For example, in a reporting product, the ability to export to PDF being offered in the lowest tier. Including such features makes the analysis harder to interpret and obscures where meaningful differentiation exists. The grid should therefore focus only on key weaknesses and differentiators from a customer’s perspective.

Feature depth

Some weaknesses may lie in the depth of features rather than in the features themselves. You would need to analyse a competitor’s product to determine this. Include feature-depth weaknesses only when they will impact buying behaviour. If you identify a significant weakness, you may wish to educate your customers in your marketing. Not by specifically calling out a competitor, but by emphasising your own capabilities in areas where competitors fall short.

| Feature Category | Feature | Competitor A | Competitor B | Competitor C | Importance to Purchase Decision | Reasons (Customer Evidence) |

|---|---|---|---|---|---|---|

| DIFFERENTIATING FEATURES (Drive customer purchase decision) | ||||||

| Reporting & Analytics | Predictive analytics | Enterprise | – | – | High | Comp A is the only vendor offering predictive analytics, highlighted by enterprise customers as critical for decision-making |

| Reporting & Analytics | Custom dashboards | Pro+, Enterprise | Pro+, Enterprise | Pro+, Enterprise | High | Comp B provides more dashboards and flexibility, which customers cite as essential for complex reporting workflows |

| Collaboration | Real-time editing | Pro+, Enterprise | Basic, Pro+, Enterprise | None | Medium | Comp B provides real-time editing at lower tiers, enabling easier adoption and faster collaboration, noted in customer reviews |

| Integrations | API access | Pro+, Enterprise | Basic, Pro+, Enterprise | Pro+, Enterprise | Medium | Comp B allows developer access at lower tiers, accelerating integrations and adoption, mentioned by customers as a differentiator |

| Customisation | White-labelling | Enterprise | – | – | High | Comp A is the only vendor providing white-labelling, which enterprise customers highlight as essential for branding |

Analysing your competitors’ strategy

Now is the “so what”. Under the following questions:

Summary grid should contain:

5 C's are

Company Objectives - what are the tiers trying to achieve?

Customers - who is their ICP

are, Costs, Competition, and Channel Members

Benefits

Discounting reduces.

Deal debates shrink.

Value becomes easier to communicate.

Growth becomes more predictable.

| Pricing Strategy | Competitor A | Competitor B | Competitor C |

|---|---|---|---|

| PRICING STRATEGY ASSESSMENT | |||

| Penetration | 2 — Free tier and 14‑day starter trial lowers initial barrier; basic tier priced competitively for small teams. | 2 — Free tier plus 30‑day trial increases adoption; basic pricing within expected range. | 2 — No free tier but low entry starter price and 14‑day trial support initial acquisition. |

| Expansion (Land and Expand) | 3 — Clear progression from free → basic → professional → enterprise with usage increases (users, API, storage). | 3 — Large usage caps and extended trial encourage growth into higher tiers. | 3 — Mid-tier targets mid-sized businesses with scaled limits, driving upgrades. |

| Upsell | 3 — Distinct tier value jumps between basic → professional → enterprise. | 3 — Incremental feature and support improvements differentiate adjacent tiers. | 3 — Professional to enterprise pricing and support upgrades clearly staged. |

| Profitability | 2 — Tier pricing spreads balance volume and margin; enterprise tier priced for high budgets. | 2 — Mid and top tiers priced to sustain revenue; usage overages boost profitability. | 1 — Narrow tier spreads and simpler pricing suggest less emphasis on margin optimisation. |

| Defensibility | 2 — Restrictive seat caps and differentiated support increase switching cost. | 2 — Unlimited usage on mid tier and priority support at enterprise create value lock-in. | 1 — Lower limits and simpler enterprise positioning make switching easier. |

| Skim | 2 — Enterprise pricing at premium level captures high willingness-to-pay customers. | 1 — Top tier premium pricing moderate; less aggressive than classic skimming. | 1 — Enterprise tier lower; pricing doesn’t signal strong premium capture. |

| No clear strategy | 0 — Clearly tier-based logic. | 0 — Clear structure and progression. | 0 — Rational tiering present. |

| CONCLUSION | |||

| Most likely pricing strategy(s) | Expansion (Land and Expand), Upsell | Expansion (Land and Expand), Upsell | Expansion (Land and Expand), Upsell |

| Evidence | Free tier + trial, tight tier spacing, strong usage escalation (users, API, storage), premium enterprise pricing drive upgrades and sustained revenue. | Extended trial periods, largest usage caps, comprehensive support; tier jumps are well-differentiated and boost upsell. | Competitive mid-tier pricing with clear feature & usage increases encourages progression; supports expansion and upsell focus. |

xxxx

Tactical discounting that erodes margins

Late-night debates about “what price should we submit”

A cost-plus mindset that undermines product value

Constant reactions to competitor changes

5 C's are Company Objectives, Customers, Costs, Competition, and Channel Members

Create your pricing tiers

You will then set your price:

Low positioning - Aggressive acquisition strategy, too low and it may signal lower quality.

Mid positioning - Balanced approach, competitive without devaluing offering.

High positioning - Premium strategy, requires strong differentiation to justify.

Price is the primary filter - Customers evaluate products by price point first. If your Basic tier is £500pm and competitors are at £300pm, many won't even look at your limits.

Competitive price bands exist - The market creates natural price clustering (e.g., entry tiers at £200-400pm, mid-market at £800-1200pm). You need to fit within these bands to be considered.

Limits are the value justification - Once price is competitive, limits determine whether you offer good value at that price point.

Creating your pricing tiers

Create your tiers, taking into account your Ideal Customer Profile (ICP). The ICP is where you generate the most profit and have sustainable growth. Instructions for ICP creation are available in the B2C Customer Persona Canvas and B2B Company Profile Canvas:

Design tiers that collectively address your full market opportunity.

Identify your ICP and align it with a specific tier:

While tiers let you serve multiple segments, your ICP determines where to focus product development, sales resources, and marketing efforts. For example, if “Advanced” customers are your ICP, their tier receives priority investment, even though you maintain Basic and Enterprise tiers.

Be cautious with your tier focus. Although the wider market may now appear accessible, it can open you up to revenue risk. You may want to drop a segment when you identify issues like below:

Enterprise segments can be deceptively resource-intensive—demanding extensive customisation, lengthy sales cycles, and ongoing relationship management that erode profit margins. If Enterprise isn't your ICP, these demands can divert critical development resources from your core product.

Basic tier customers may require disproportionate support relative to their revenue contribution, creating negative unit economics. High support volumes for low-value customers can strain operations and distract from higher-value segments.

Consider a low price option / freemium tier with low usage limits to hook clients:

The cost of providing the product must be very low to avoid loss or low profit.

Functionality across tiers

We need to decide what features and their corresponding feature depth to match the tiers. Below is a good place to start:

Freemium tiers

Freemium / low-priced tiers must include at least enough functionality for the customer to solve their problem. Anything less than this and the customer will probably not buy from you, or if they do, you will see very low satisfaction scores. For example, imagine a washing machine without a spin cycle.

Low-priced tiers

Low-priced tiers must be competitive at the price point. This means they should match competitor offerings to stop customers from going elsewhere. For example, if all cars at the price have air conditioning, even if it is not required, it is expected.

Higher-priced / ICP tiers

With your ICP-aligned tier, you aim to outperform your competitors. Focus on strong differentiation through:

Features that competitors lack entirely.

Capabilities where competitors execute poorly.

Greater depth in key functionality than competing offerings.

Nullifying competitor differentiators

ddd

Enterprise tiers

Enterprise customers may have additional needs:

Bespoke features - ensure development costs don't exceed the revenue they generate.

Custom integrations (e.g. ERP systems, accounting packages).

Dedicated support with enhanced Service Level Agreements (SLAs).

Tailored workflows specific to their operations, e.g. automated routing based on their specific business rules (e.g. purchase orders over £10k require CFO sign-off).

Premium functionality that justifies custom pricing.

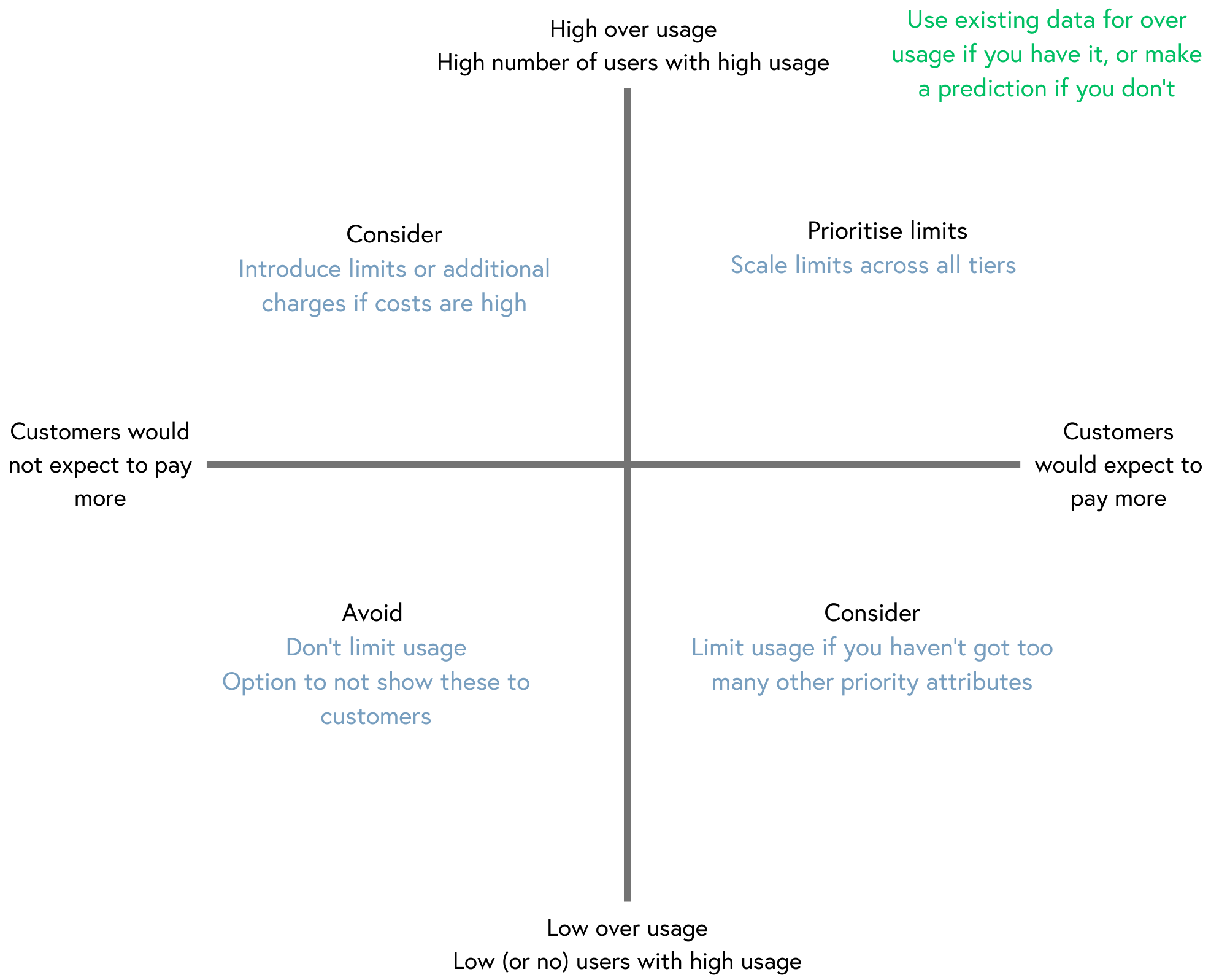

Usage limits across tiers

In addition to limiting functionality, you can set usage limits across your product's pricing tiers. This is especially important when usage incurs significant costs, such as data storage, API calls, or processing power. Usage limits provide a natural upgrade path as customers grow. They can also be deliberately set low on freemium tiers to drive initial adoption and encourage fast upgrades.

The grid below will help you decide what to limit:

Functionality across tiers

We need to decide what features and their corresponding feature depth to match the tiers. Below is a good place to start:

Freemium tiers

Freemium / low-priced tiers must include at least enough functionality for the customer to solve their problem. Anything less than this and the customer will probably not buy from you, or if they do, you will see very low satisfaction scores. For example, imagine a washing machine without a spin cycle.

What limit to set

With your

| Tier / Price Point | Usage Metric | Competitor A | Competitor B | Competitor C | Your Product (Target) | Max Cost to Serve |

|---|---|---|---|---|---|---|

| Freemium / Free | Projects | 5 | 10 | 3 | 10 | £0.50 |

| Storage | 500MB | 1GB | 250MB | 1GB | £0.20 | |

| Users | 1 | 2 | 1 | 2 | £0.10 | |

| Basic / £300pm | Projects | 50 | 40 | 60 | 60 | £30 |

| Storage | 10GB | 15GB | 8GB | 15GB | £20 | |

| Users | 5 | 10 | 5 | 10 | £15 | |

| Professional / £1000pm | Projects | 200 | 250 | 300 | 300 | £150 |

| Storage | 100GB | 150GB | 100GB | 150GB | £100 | |

| Users | 25 | 50 | Unlimited | 50 | £50 | |

| Enterprise / Custom | Projects | Unlimited | Custom | Unlimited | Unlimited | Calculated per deal |

| Storage | Custom | Custom | 1TB+ | Custom | Calculated per deal | |

| Users | Unlimited | Unlimited | Unlimited | Unlimited | Calculated per deal |

Feel free to recreate the canvas in a tool of your choice. Please attribute the author (Timothy Field), the source of the canvas (this webpage) and add the CreativeCommons BY-SA license

Trend analysis

There can be m

xxxxs

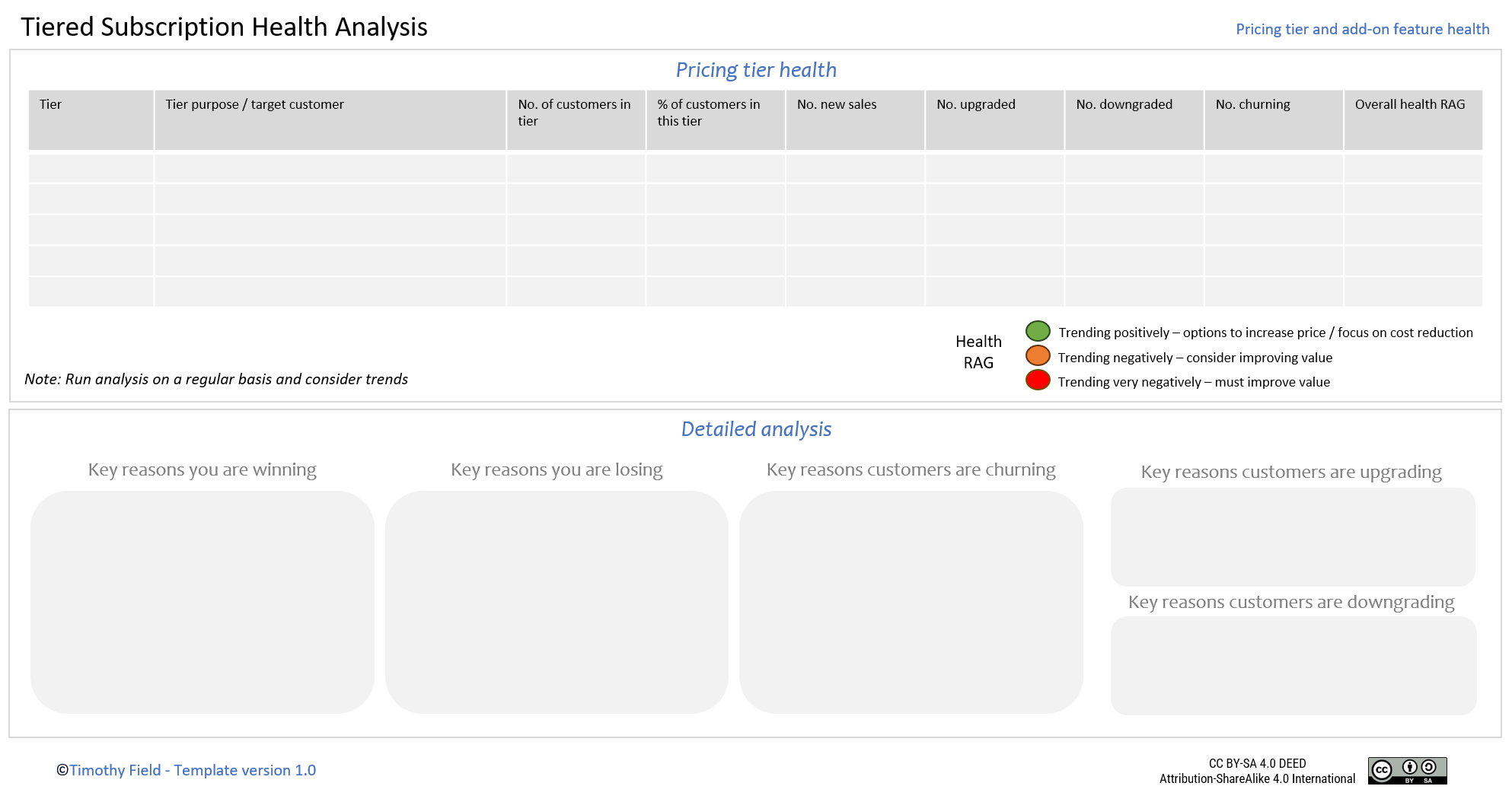

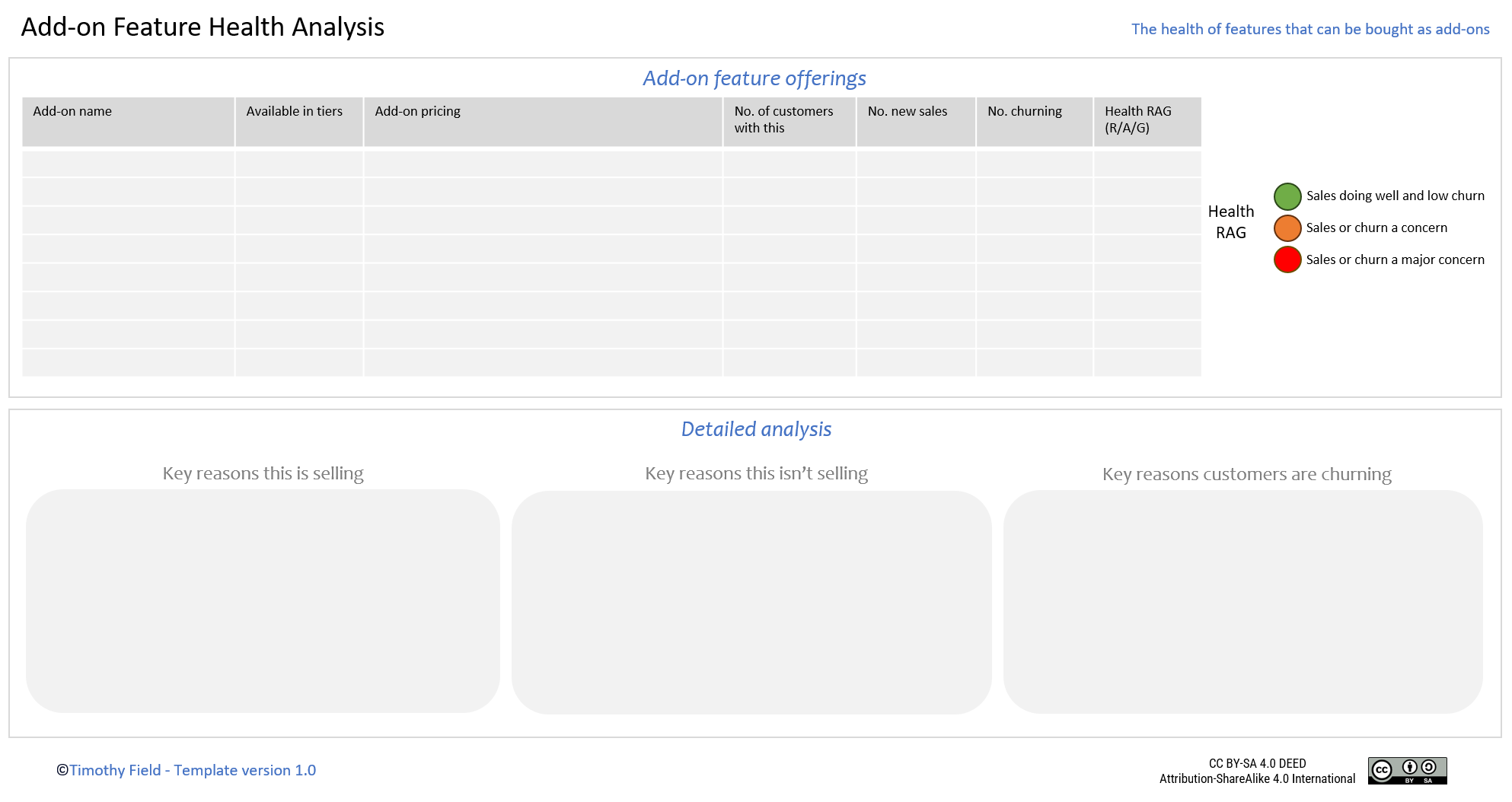

Tiered Pricing Health Analysis

This canvas can be used to assess your pricing tiers and add-on feature health (features that can be bought for an additional price). There are two canvases provided for this.

Pricing history and stakeholders

When considering working on pricing

Ensure you understand what pricing has and hasn’t worked previously

Why does the current pricing plan look like this?

Who are your key decision makers?

How often do they need to be consulted?

How should they engage? Part of the core team / regular reviews / just interested

Tiered Subscription Health Analysis

For each pricing tier consider for these:

If they are meeting customer expectations.

If they are cost-efficient - For example, custom migration can get very expensive, and the pricing tier revenue may not cover the costs.

Competitor analysis and pricing

The competitor analysis feeds the overall pricing health. You should, therefore, start there (the first tab) before attempting the canvas below.

Feel free to recreate the canvas in a tool of your choice. Please attribute the author (Timothy Field), the source of the canvas (this webpage) and add the CreativeCommons BY-SA license

Tiered Subscription Health Analysis

Add-on features can be difficult to sell. They must have sufficient value to justify their price. They should be treated as independent products that need to achieve their own product market fit.

Feel free to recreate the canvas in a tool of your choice. Please attribute the author (Timothy Field), the source of the canvas (this webpage) and add the CreativeCommons BY-SA license

Service Design

An end-to-end service view considers not only the customer touchpoints but behind the scenes processes. These can be the cause of great inefficiencies and may even represent delays that the customer sees. The granularity of this view can be from a high-level overview to more detailed process flows. Below is an example of a more detailed flow. The pain points are recorded on the flow diagram. These should be quantified and prioritised if they are to be taken into the canvas.

Revenue and pricing models

First, it is important to note that there are no industry-standard definitions for the pricing terms used here. Some people treat a “revenue model” as the entire pricing strategy. To create a usable guide, it will follow a distinct set of definitions:

Revenue model - How you charge your customers:

Core - These are the foundational revenue models for a business, each of which can operate as a standalone revenue model. For example, you could build an entire SaaS company based solely on per-user pricing.

Supplementary - You can choose to layer in supplementary offerings, such as a configuration project option with its own price.

Pricing model(s) - The method used to calculate the price for a single billable component (one pricing model per component), e.g. price per seat, capacity-based. You may be billing on multiple aspects.

Pricing strategy - When you set your pricing, e.g. penetration pricing - going in really cheap to win a large section of the market.

Pricing implementation/package - The specific implementation of your pricing taking the above factors into account. For example:

Usage-based revenue model with a flat fee of £10 per GB of database storage. This is using a penetration pricing strategy to win new customers, as this is much cheaper than the competition.

A pricing implementation can be a complex combination of revenue and pricing models. For example, you decide to combine a per-seat subscription with usage limits. The guide below shows the most common building blocks.

Revenue models

This section covers how you charge your customers.

Core revenue models

These are the foundational revenue models for a business, each of which can operate as a standalone revenue model. For example, you could build an entire SaaS company based solely on per-user pricing. You must select at least one core model as your primary revenue engine. Supplementary revenue models, by contrast, cannot stand alone. They require an established core product and customer base. For example, you cannot build a SaaS business purely on add-ons or a fixed-price training programme. After selecting your core, you can add these supplementary offerings.

Usage-Based - Customer pays for what they use/consume.

Always use when - Your product has one or more types of usage that meet these three conditions (critical selection requirement):

1) Your costs scale directly with consumption.

2) Consumption varies significantly between customers. E.g. Limits would not be required if all customers used 2GB of storage, regardless of its cost, you could factor this into a single price.

3) These costs are high enough to significantly impact profitability.

Where the conditions are met, you must include these aspects in your pay-per-use charging, for example, you offer a cloud solution, and storage is very expensive, but network bandwidth is not.

Works well when customers resist upfront commitments, and you want to remove adoption barriers by letting customers pay only for what they use. However, this means monthly revenue is unpredictable and difficult to forecast, complicating financial planning.

Per-User - Prices are multiplied by the number of users or seats. Common for team collaboration tools, where each person needs access.

Use when:

You want pricing that's simple and predictable for customers to calculate.

Your customer segments vary significantly in team size (from individuals to large organisations).

You want revenue to grow automatically as customer teams expand.

Example: Slack charges per active user per month.

Transaction-Based Commission - You earn revenue by charging a fee on each transaction.

Use when:

Your platform facilitates transactions between parties (e.g. eBay connecting buyers and sellers) OR processes payments/transactions for customers (e.g. Stripe).

You want to eliminate barriers to entry - customers can start for free and only pay when transactions occur.

Revenue scales directly with transaction volume on your platform.

Examples:

Stripe charges 2.9% + 30¢ per payment transaction.

Airbnb charges 3% from hosts + 5-15% from guests per booking.

Etsy charges sellers a fee per sale.

Subscription to Product - A recurring fee charged at regular intervals for continued access or entitlement to a product.

Use when – Your product meets these conditions:

Usage pattern - Customers use your product regularly and frequently enough that unlimited access is more valuable than metered consumption.

Customer preference - Customers value cost predictability and "all you can use" simplicity over usage tracking.

Cost structure - Your costs don't scale significantly with individual customer usage that would make metering necessary.

Highly predictable recurring revenue enables easier financial forecasting and cash flow management, but revenue growth from existing customers requires them to actively decide to upgrade tiers (creating friction at decision points), unlike pay-per-use, where expansion happens automatically with usage.

Freemium - Free Product for Life (Foundational Choice): While technically not a revenue strategy, the decision to include a free permanent offering is a foundational choice that impacts your customer acquisition strategy, conversion funnel design, and support costs. Freemium models use a free offering to drive adoption, then convert customers to paid plans by imposing feature limits, usage caps, or advanced functionality.

Use when — You have a product with low marginal costs per user, can acquire users virally or through self-service, and have clear upgrade triggers (feature needs, usage limits, team growth). Common in B2B SaaS targeting SMBs and individuals.

You're targeting a large addressable market where customers are much more likely to purchase after trying the product with ongoing free access - this enables broader reach and increases the chances of driving viral growth.

You have natural growth built into the product, coupled with clear triggers that motivate free users to upgrade (usage limits, feature needs, team growth).

You can support free users economically (including the cost of onboarding), either through very low costs or having capital to invest with strong conversion economics that justify the investment.

Example: Jira offers a product limited to 10 users, then upsells when more are required.

Tiered Subscription (Foundational Choice): While technically a customer acquisition model, the decision to use tiered vs. flat-rate subscription is a foundational choice that impacts your entire business model. Tiered subscriptions (Basic, Pro, Enterprise) enable market segmentation, create natural upsell paths, and help you to capture more value across different customer segments. This choice affects product development, sales strategy, and revenue growth potential.

Use when:

Your customer segments have distinctly different needs - for example, some need only basic functionality while others require advanced capabilities.

You've built genuinely differentiated feature sets or offer service levels that deliver progressively more value to address these different needs.

Customers have significantly different willingness-to-pay based on their needs with some willing to pay substantially more.

Tiered models are highly flexible and can incorporate many of the pricing models above. For example, adding a free tier (freemium), per-seat pricing within each tier, usage-based limits or overages between tiers, or feature-based differentiation between tiers.

Example: Slack offers Free, Pro, Business+, and Enterprise Grid — each tier combines per-seat pricing with different feature sets and usage limits.

Hybrid: Hybrid revenue models are a combination of the above. Mixing Usage and Subscription is very common and is used as an example here.

Usage & Subscription example - Combines recurring subscriptions with usage-based charges. For example, offering a monthly/annual base subscription with an allowance, with usage beyond that billed at a per-unit rate.

Use when – Your product meets the following conditions.

Customer preference - Customers need budget predictability and fear bill shock from pure usage-based pricing, but their consumption still varies enough that some should pay more for heavy usage.

Usage costs: Meets the criteria for pay-per-use. Your costs scale directly with consumption, consumption varies significantly between customers, and these costs are high enough to warrant metering.

Supplementary revenue models

There are many supplementary ways to generate revenue. Here are some of the most common in SaaS:

Add-ons & Feature Upgrades - One-time or recurring charges for optional features beyond the base subscription.

Examples: Additional user seats, advanced reporting tools, extra storage capacity, premium templates, increased API rate limits, specialised modules

Use when: Features serve niche use cases that not all customers need. Allows monetisation of advanced functionality without forcing customers into higher-tier plans.

Note: Keeps base pricing accessible while capturing additional value from power users who need specific capabilities.

Professional Services - Customer pays for expert services that go beyond the core offering.

Examples: Implementation/onboarding projects, custom integrations, data migration, custom development, strategic consulting, training programs, technical assessments.

Use when: Customers need specialised expertise for setup, customisation, or optimisation. Work is typically scoped with specific deliverables or outcomes. Sold as fixed-price projects, hourly/daily rates, monthly retainers, or statement-of-work agreements.

Key characteristic: Non-recurring or episodic, human-delivered expertise that extends beyond standard product capabilities.

Support/Maintenance - Ongoing assistance with using the product, typically included in subscription tiers or sold separately.

Examples: Technical support (email, chat, phone), SLA guarantees (response times, uptime), priority support, dedicated support engineers, 24/7 availability.

Common models:

Tiered within subscription - Basic support in lower tiers, 24/7 or faster SLAs in higher tiers (most common).

Add-on support packages - Premium support sold separately (e.g., "+£500/month for dedicated account manager").

Included vs. paid - Community/email support free, phone/priority support paid.

Use when - Part of your core offering differentiation (enterprise customers expect better SLAs) or when premium support justifies additional revenue.

Key characteristic: Ongoing, reactive help with existing product functionality.

Marketplace/Platform Fees - Revenue from third-party developers or partners selling on or integrating with your platform.

Examples: App store revenue share (Shopify App Store, Salesforce AppExchange), integration marketplace fees, partner referral commissions.

Use when: You have an established platform with ecosystem value. Creates a two-sided marketplace where partners extend your platform's capabilities, and you take a percentage of their sales.

Note: Requires significant platform maturity and a user base to attract third-party developers.

Free trial: While technically not a standalone revenue model, a free trial is a proven customer acquisition strategy. It drives revenue by letting customers experience value firsthand, rather than relying on marketing claims or perception alone. Perception can be heavily influenced by negative reviews. It can be extremely high-risk if your product isn't intuitive or is difficult to set up. Customers may quickly leave the free trial and not return. To counter this, a sales team can monitor trial activity and step in where needed to guide users toward conversion (product-assisted sales).

Use when:

You have a product that is simple enough for a customer to use themselves, or you have the resources to offer guided support to ensure they succeed in using it.

You want to create a filter that attracts more serious buyers to create stronger conversion over broad top-of-funnel volume. In SaaS, a typical conversion rate is 25%, whereas Freemium can be as low as 2.6%.

You want to create a sense of urgency to convert customers faster, which needs to be balanced with the pressure of customers comparing tools too quickly.

Example: Notion offers a free tier with limited features, then upsells to Plus, Business, and Enterprise plans.

Additional revenue models:

Advertising Revenue - Display ads to free-tier users or within the platform.

Affiliate/Referral Revenue - Earn commissions by referring customers to partner products.

Licensing/White-Label - License your technology to partners who rebrand or resell it.

Data/Analytics Services - Sell aggregated insights, benchmarking reports, or market intelligence.

Managed Services - Provide ongoing operational management of the platform for customers.

Hardware/Physical Products - Sell complementary physical devices (IoT, terminals, etc.).

One-Time Perpetual Licenses - Sell permanent licenses instead of subscriptions (legacy model).

Reseller/Channel Partner Revenue - Revenue from partners who resell your product.

Certification/Training Programs - Charge for official certifications or structured training courses.

API Access Fees - Charge separately for API access or higher rate limits (when not part of core subscription).

Pricing options for core revenue models

With a revenue model selected, you need to decide how the pricing will work for it. There are multiple ways to structure pricing, from a single fixed price to volume-based discounts. The available options differ depending on the revenue model(s) you've selected.

Note: This step is about choosing your pricing structure, not setting actual prices. For example, you might decide on "per-user pricing with volume discounts," but the specific numbers (£10/user for 1-10 seats, £8/user for 11-50 seats) come later in your pricing strategy.

Below are the pricing model options, organised by revenue model, with guidance on when to select each.

Subscription to product revenue model

Charging for continued access or entitlement to a product. Prices based on:

Feature-based - Different modules/features at different prices. Example: HubSpot sells Marketing Hub, Sales Hub, and Service Hub as separate modules.

All-inclusive - Single price, all features included.

Usage-based revenue model

You bill on specific usage metrics. For each metric, choose how to price it:

Common SaaS usage metrics:

Database storage/usage

API calls (by endpoint/complexity)

Compute hours

Bandwidth/data transfer

Messages sent (email, SMS, notifications)

Data processed

Pricing options for each metric:

Flat-rate - Fixed price per unit (£0.10/GB, £0.01/API call). Example: Twilio charges per SMS.

Volume-based - All units repriced at higher volumes. Example: If usage exceeds 1,000 units, all units are billed at a discounted rate.

Tiered - Different rates at volume thresholds (first 1,000 units at £1, next 1,000 at £0.50).

Stair-step - Fixed price for usage within bracketed ranges (0-100 units: £100, 101-500 units: £400).

Dynamic - Price varies by demand, time, or complexity (e.g., premium AI endpoints cost more than basic endpoints, peak hour pricing).

Capacity-based - Pre-purchase reserved capacity blocks drawn down over time. Example: AWS Reserved Instances.

Credit-based - Pre-purchase credits to draw down as you use services.

Example: You might bill on storage (flat-rate £0.10/GB) AND API calls (tiered: first 10k free, then £0.001/call, premium AI endpoints £0.01/call) AND compute hours (capacity-based: £100/month for 10 reserved cores).

Per-user revenue model

Prices based on:

Flat per-user pricing - Same price per user regardless of volume (£15/user/month).

Volume-based per-user pricing - Price per user decreases with more seats (1-10: £20/user, 11-50: £15/user, 51+: £12/user).

Per-active-user pricing - Only pay for users who actively use the software in the billing period.

Transaction-based commission revenue model

Prices based on:

Percentage-based - Fixed % of transaction value (2.9%).

Fixed fee - Flat fee per transaction (£0.30).

Percentage + fixed - Combination (2.9% + £0.30). Example: Stripe's standard pricing.

Category-based rates - Different commission rates for different product/service categories or transaction types.

Split commission - Charging fees to both parties in the transaction (e.g. both buyer and seller).

Volume discounts - Lower charges at higher transaction volumes.

Implementing tiered pricing

Most successful tiered structures combine several of these patterns. Tiered structures (Basic/Pro/Enterprise) are packaging frameworks that combine multiple pricing elements to create distinct offerings at different price points. Tiers are commonly used with Subscription and Usage-Based revenue models to segment customers and create upgrade paths. Tiered pricing can include a Freemium offering, where allowances and feature availability are deliberately scaled back to drive a purchase decision.

Common Tiering Patterns

Usage Limits/Benefits Within Tiers

Different tiers include different usage allowances or rates for the same usage metric:

Storage limits increase: Basic (10GB included), Pro (100GB), Enterprise (1TB).

Usage rates get cheaper: Basic tier pays £0.10/GB for storage, Pro pays £0.08/GB, Enterprise pays £0.05/GB.

Free usage allowances grow: Basic (1,000 API calls/month included), Pro (10,000 included), Enterprise (100,000 included).

Higher tiers unlock unlimited usage: Basic (capped at 5,000 emails/month), Pro (25,000), Enterprise (unlimited).

Feature Availability Across Tiers

Higher tiers unlock additional features or modules.

Per-User Pricing Within Tiers

Each tier has per-user pricing, but the per-user rate or feature set differs:

Same per-user rate, different features: Basic (£10/user - core features), Pro (£20/user - advanced features), Enterprise (£30/user - all features).

Different per-user rates: Basic (£15/user), Pro (£12/user), Enterprise (£10/user).

User limits per tier: Basic (up to 10 users), Pro (up to 50 users), Enterprise (unlimited users).

Example: Slack offers Free, Pro, Business+, and Enterprise Grid — each tier combines per-user pricing with different feature sets and usage limits.

Capacity/Service Levels Across Tiers

Higher tiers include better performance guarantees, SLAs, or capacity allocations:

SLA improvements: Basic (99% uptime), Pro (99.9% uptime), Enterprise (99.99% uptime + dedicated support).

Support levels: Basic (email support), Pro (email + chat), Enterprise (24/7 phone + dedicated account manager).

Performance tiers: Basic (shared infrastructure), Pro (dedicated resources), Enterprise (guaranteed capacity).

Rate limits: Basic (100 requests/minute), Pro (1,000 requests/minute), Enterprise (10,000 requests/minute).

Hybrid Usage + Subscription Tiers

Each tier has a base subscription fee plus different usage pricing or allowances:

Base fee + included usage + overages: Basic (£50/month + 5GB storage, £0.10/GB overage), Pro (£150/month + 50GB, £0.08/GB overage), Enterprise (£500/month + 500GB, £0.05/GB overage).

Base fee + usage pricing varies by tier: Basic (£20/month + £0.10/API call), Pro (£100/month + £0.05/API call), Enterprise (£500/month + £0.02/API call).

Freemium + paid tiers: Free (limited features + 1GB storage), Pro (£10/month + 10GB + advanced features), Enterprise (custom pricing + unlimited).

Add-ons Available by Tier

Certain add-ons or premium features are only available to specific tiers:

Tier-restricted add-ons: The advanced analytics add-on is only available for the Pro tier and above.

Progressive add-on access: Basic (no add-ons), Pro (can purchase premium integrations), Enterprise (can purchase custom development).

Volume discounts on add-ons: Additional storage costs £10/GB in Basic, £8/GB in Pro, £5/GB in Enterprise.

UX vision

Before creating a UX vision, you should have some strategic options generated from the earlier outputs, such as the customer pain points.

The UX vision shows potential high-level system flows. It allows us to provide a good product experience by considering the customer experience as a whole. For example, you may change how customers navigate and interact with your product and would like to visualise this journey. It needs sufficient functional depth for people to understand the strategic options. You are very unlikely to build everything that the vision has within it.

This output is used when prioritising your Strategic Areas. It will allow the leadership team to synchronise on what their options really mean and is a great starting point for discussion.

The UX concept output in the Minimum Valuable Increment stage is a more detailed visual output created to guide development. The UX vision can guide the UX concept as a starting point.

Prioritisation

The process below is one way of prioritising. Many alternative techniques exist, such as Weighted Shortest Job First (WSJF). There are issues with these other techniques. For example, you may not take into account your competitors strengths or your own operational costs. The techniques below allow you to better structure this activity. Be aware that prioritising work items is not the same as prioritising strategy. Work items are much lower level. If you are finding your own process is not giving you the expected business results, you should consider either augmenting it or replacing it with the one below.

Capacity planning

Each team should be linked to a strategy. Avoid linking a team to more than one strategy, especially if it creates resource bottlenecks. You can also have multiple teams linked to a strategy. In this case, it is advisable to be clear about who owns it. Consider prefiltering your strategy items based on capacity. Having 2 teams and evaluating 30 potential strategies will be a waste of time and effort.

Types of work

Each strategy item should fall under one of these categories:

Mandatory work - Keep the lights on, legal, compliance

Protect market position - Avoid sales loss and churn

Reduce operational costs - High costs can negate any revenue gained by sales. By removing high-cost areas, you can increase profit.

Growth - You reach into new markets or press your advantage against a failing competitor

The process below helps you consider where to put your effort. The Strategy Item structure is on the main page above this detailed guide.

Prioritisation Process

Assess your strategic position

Consider your current strategic position at a high level before prioritising individual strategies. If you are losing a great deal of sales to a competitor you may not even want to consider operational improvements.

Pricing strategies

This section provides detailed guidance on how each pricing strategy is implemented. Use this whether you are analysing a competitor or designing your own pricing. This section is in two parts:

Types of pricing strategy - The different strategies an organisation can implement.

No clear strategy - The evidence that you or your competitors do not have a well-implemented strategy.

When to use each strategy - Advice on when to implement and the key risks of each.

Types of pricing strategy

Each section includes “Tiered subscription pricing”, which shows how it would be implemented under this pricing model.

Penetration

The goal is to win as many customers as possible by offering a price and value that is hard to refuse, even if this means lower or no short-term profit. A penetration pricing strategy can be used with a new product to gain market share. Prices may rise when the organisation has gained enough customers. If existing competitors respond to penetration pricing, you can see a race to the bottom, with profits significantly shrinking across the market. Organisations should only maintain penetration pricing when:

There is a sustained increase in sales.

If operating at a loss, they can afford to continue to do so.

This strategy is very dangerous when an organisation has higher operating costs than its competitors. If competitors respond and keep prices low, the organisation may go out of business.

How this is implemented:

Pricing is noticeably lower than the market, not just at one point but across the board.

Customers get meaningful value early, without hitting constraints that slow them down.

Friction is removed from the buying process to onboard many customers quickly, i.e. self-service, easy sign-up, no sales gatekeeping.

Aggressive discounts are used to lock in volume quickly.

Tiered subscription pricing — Free trials are long. Usage limits are generous relative to the price, particularly at the entry level. The freemium tier includes enough functionality to experience real value. All tiers would likely be priced aggressively low compared to competitors.

Expansion (Land and Expand)

The goal is to acquire many customers, some of whom will naturally increase their spending over time as their usage increases. This is not applicable for flat-rate pricing. This is risky if cost-to-serve or customer acquisition costs are high. Having many low-value customers who do not expand can erode your profit margin. In this scenario, there should be good data to predict expansion rates.

How this is implemented:

The entry point is generous enough to build habit and dependency.

The path from small to large spend is driven by the customer's own growth. They can buy more frequently, in larger quantities, or add complementary products over time.

Customers who increase their spending are rewarded with better support, more capability, volume discounts, or loyalty benefits.

Higher spend levels are rewarded with better support, more capability, or both.

Tiered subscription pricing — Usage limits are set high enough that most customers won't hit them during normal growth. When limits are exceeded, upgrades happen automatically through self-service billing changes rather than requiring new contracts. Clear, accessible usage dashboards show customers how close they are to limits. Overage pricing is competitive enough that customers don't call support seeking ways to avoid costs. Each tier upgrade feels like a natural next step rather than a forced jump.

Profitability-Focused Filtering

Discourage or filter out customers who will not be profitable given your cost structure, while guiding profitable customers toward appropriate price points or packages. This strategy is used when cost-to-serve or acquisition costs are high, and data show that certain customer types, whether small or large, will not be profitable.

How this is implemented:

Product tiers, packages, or usage options are designed to align revenue with cost-to-serve.

Constraints may be applied strategically to discourage unprofitable behaviour or customer types. This could include setting high prices or limiting service quality. For example, to discourage light users, setting a high entry price, or to discourage enterprise customers, not offering premium integrations.

Messaging emphasises the benefits of higher-value options and the limitations of lower-value or high-cost options.

Tiered subscription pricing - Usage limits or feature access are set to ensure that customers who are too costly to serve either upgrade to a profitable tier or self-select out. Pricing and restrictions are designed to capture profitable customers while minimising support or delivery costs for high-cost customers.

Premium / Margin-Focused Pricing

The goal is to maximise margin by leveraging market leadership and a strong brand, focusing on high-margin operations rather than growth.

How this is implemented:

Pricing is at or above market rate. The organisation is not competing on price.

Discounting is limited and not used as a lever to win business.

The sales process is relationship-driven, particularly at higher spend levels.

The pricing structure is stable and does not shift frequently in response to competitors.

Tiered subscription pricing — Usage limits are generous at higher tiers, reflecting confidence that customers will pay and stay without needing to be incentivised. Enterprise pricing is custom or negotiated. Annual discounts are modest.

Price Discrimination

The goal is to accelerate growth and adoption by offering tailored pricing to different customer segments based on willingness to pay, usage patterns, or other relevant criteria.

How this is implemented:

Prices are differentiated for clearly defined, justifiable segments, such as students, seniors, regional markets, or volume tiers.

Publicly visible price differences are communicated transparently and framed in a fair, understandable way.

Differences may be hidden or negotiated for B2B contracts, loyalty programs, or bulk orders.

Discounts, promotions, or special rates are tied to segment-specific criteria.

Monitor to ensure that price differences do not harm customer perception of fairness or trust.

Tiered subscription pricing — Offer a discount across every tier for a specific group. For example, students get 50% off all tier prices.

Freemium Pricing (predominantly used in software/SaaS businesses)

A free version of the product is offered with meaningful but limited value, designed to drive adoption and conversion.

How this is implemented:

The free tier delivers real, usable value.

Clear constraints exist (features, scale, limits) that create upgrade pressure.

Paid tiers unlock advanced functionality, scale, or control.

Conversion paths are explicit and visible.