B2B - Company profile canvas

This canvas helps you better understand and target the companies you sell to. The segmentation categories are different for identifying companies versus selling to customers (B2C) hence, a separate canvas is required. Business-to-business (B2B) selling can be much more difficult and time-consuming. It is, therefore, particularly important to refine who you target. You should also factor in the additional opportunity cost of spending time with organisations that have little interest in your product. In a subscription-based model, you may have specific company types targeted at different pricing tiers.

Creating a persona is an iterative process. As you sell your offering, you can refine your target market (ICP refinement tab). You may start by marketing to several different types of companies and seeing which yields the best results.

Ideal Customer Profile (ICP)

Your ideal customer (ICP) helps you increase your chance of success:

You can create a product that will better match their needs, leading to them buying more.

Be more efficient with marketing and sales efforts.

Maximise profit.

The creation of the ICP is detailed in the segmentation tab. Competitors may not be targeting exactly the same customer groups as you. Despite this, there may still be some overlap. The diagram below shows an ICP that is partially impacted by competitor X:

B2B - Company Profile Canvas

Feel free to recreate the canvas in a tool of your choice. Please attribute the author (Timothy Field), the source of the canvas (this webpage) and add the CreativeCommons BY-SA license

Subscription-based sales

Companies that have different priced tiers may be catering to different company profiles. In this case, you would create more than one canvas. For example, your basic tier sells to companies with a simple use case who want a low price, whilst your highest price tier sells to large companies with high technical capability. With a new product, it is advisable to have very similar personas if you have more than one. For example, their needs are the same, but their budget varies.

Background information

Company type

This is a brief description of the type of company you are targeting. Examples include fintech startups, marketing agencies, small IT consultancies, etc. It is usually easier to start at the segmentation section before creating this summary.

Description

This provides a more detailed background. To bring this to life, you could provide more details about the companies you have sold to. Note where you have specific company types targeted at different pricing tiers.

Ideal Customer Profile (ICP)

The ICP denotes who you are currently targeting to maximise revenue. Organisations may target different company types over time. For example, you start with small businesses and then pivot your ICP to medium-sized. It will be beneficial to create a persona for both. It is especially important to track churn in this instance. You may have to pivot back to your original ICP if this starts to increase.

Persona anti-patterns

1) Not based on research

Making up personas is the number one anti-pattern. This means you have made a lot of assumptions about your customers or have based them on poor-quality information. If a product team wishes to get together and create personas, this is fine as long as they are validated later. Defining quantified problem statements is good practice as it requires research.

2) Irrelevant information

Talking about irrelevant information in personas, such as the fact that the person has a dog and enjoys walking. This information has no value to our product development. This anti-pattern is common when people want to bring that person to life, but it isn’t helpful.

3) Not using them in product development

You should look for real people who match your personas and then use them to test out ideas and new products. If you have a large product with many features, you may have a number of personas. When creating new features, these may be targeted more towards specific people. In this case, make it clear in your strategy which persona the feature is aimed at.

4) Not using them in product marketing

Consider where new customers can be reached, for example, the social media channels they are on, so you can target your messaging. You may also segment your current customer base and target marketing at those.

5) Not targeting specific personas

We need to be focused on who we are building and selling our product to. If we don’t do this, we end up with confusing feedback and too many wants and needs. Therefore, we should avoid creating too many personas. Imagine having 10 and trying to make them all happy! Create personas for who you are selling to.

6) Too many personas

Avoid creating too many personas. Imagine having ten and trying to make them all happy! Instead, create personas for the key company types you are selling to. If you are a new company or selling a new product, it is advisable to start with just one.

Market size

Total Area Market (TAM), Service Available Market (SAM) and Service Obtainable Market (SOM) help you define your target market. After you have created your ICP (segmentation tab), you should consider each of these and see if you need to adjust your ICP or product. You may even need to stop development.

Total Available Market (TAM)

TAM represents winning every sale in the market without restrictions. It is very useful for measuring the market’s potential for growth.

“Total Addressable Market (TAM), also referred to as total available market, is the overall revenue opportunity that is available to a product or service if 100% market share was achieved.” - Corporate Finance Institute.

Too large: For example, you are competing with the entire tyre-building industry with a new road tyre. You can do this, but it will be hard to win when the competition is very high.

Too small: You have an extremely niche product. For example, software for a very specialist type of hospital. You can do this, but expansion opportunities will be very limited or expensive. This can work if the profitability is very high. The investment may not be justified for new products if the TAM is too small.

Service Available Market (SAM)

SAM represents the proportion of TAM that you can realistically target and serve. These restrictions include:

Target restrictions such as regulations, geography and distribution.

Service restrictions such as support and logistics.

Service Obtainable Market (SOM)

SOM is the realistic amount of the SAM you can expect to win over a timeframe (e.g. a year):

For new products, this will be put in terms of stretch targets. For example, five sales in the next 6 months.

Take into account the percentage of customers that match your Ideal Customer Profile, as these are more likely to buy.

For existing products:

The likely level of sales based on previous results.

Your new messaging and features that will drive additional sales.

Your competitor’s new messaging and features that will result in them winning more business.

Company cares most about

This open section can be used to give your product, marketing and sales team an overview of this type of company's typical priorities:

The key problems they have with current solutions:

These could be issues with current competitors. For example, competitor A is too expensive, and competitor B has poor reporting.

What features resonate best with them:

Perhaps they have very technical teams and like your integration features.

How price-sensitive they are:

As this has such a high impact, it may be worth calling this out. You can include this in your segmentation categories too.

Ideal Customer Profile refinement

After you have created your ICP (segmentation tab), you should test and refine it. This analysis can be done with a sales team’s input. If the data is too difficult to collect in full, you could do this from a sample of your latest sales:

ICP - Classify sales that meet your current ICP definition and those that don’t.

Classify - Assign each sale to a grid quadrant.

Consider - Does your current ICP match your sales information?

Refine - Update your ICP as required.

Expanding your ICP

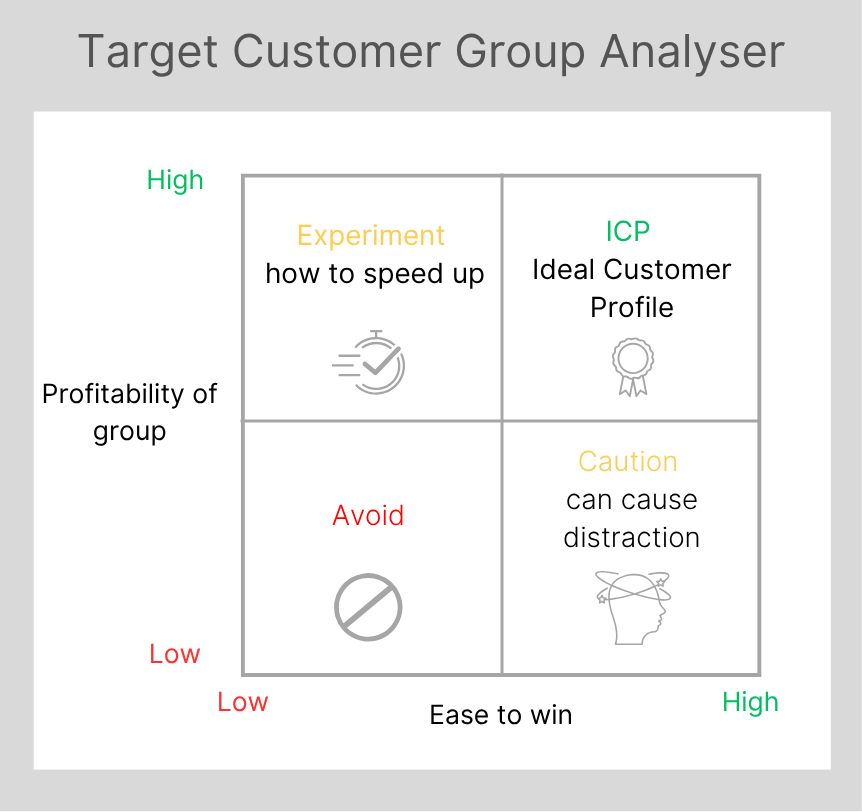

In the top left-hand side is an Experiment option. These high-value customers are hard to win. You should identify why this is. For example, they need a lot of high-cost manual product demonstrations. Create experiments to speed this up. For example, automating the product demonstration process.

Segmentation and Ideal Customer Profile (ICP)

What is product-market fit?

I’ll start with my own definition:

Product-market fit means you are providing a product or service to a group of customers that solves a big enough problem for them to want it.

How do I define a “market”?

What do I mean by “a group of customers” in the statement above? This “market” can be defined by people with the same needs or problems. Consider companies that spend a lot of time manually correcting data errors.

Company segmentation differs from that of customers. Limit your segments to four types to simplify your targeting. Segments have a type and a value. For example:

Location - North America

Status - Non-profit

Use the segmentation categories below as a starting point and add to them as you see fit.

Firmographic

Industry type

Location

Size - revenue/employee count

Performance - financial/revenue/revenue growth

Status - Corporation/Non-profit/Limited

Geographic

Country

Region

Language

Cultural preference

Time-zone

Behavioural

Source channel - referrals/campaigns/organic

Engagement style - RFP/RFI/general guidance

Content engaged - where they spend the most time

Technologies used - key technologies that they use

Needs

Price-focused - keeping the costs down

Quality-focused - best possible at a premium

Service-focused - priority to customer service

Partnership-focused - relationship trust/reliability

Ideal Customer Profile (ICP)

An ICP is the customer group you should target to maximise success/profit as shown in the grid below. They are used in marketing, sales and product development. The profitability represents the entire group, for example:

10 large customers at 100K profit = 1M total profit

500 small customers at 1K profit = 500K total profit

An example of a poor ICP would be a large customer with a very long sales cycle who demands a very low price. Although these customers may feel important, your profitability will suffer.

This shows that although you can pursue every customer who could buy, it can be a costly waste of time. You should take the following considerations into account when segmenting:

Customer needs

Market maturity stage

Disruptive innovation

Price - Sensitivity and affordability

Our restrictions

Market size

We will now look at these factors in detail.

Customer needs

We need to start with segments that differentiate customers based on the specific problems they need solving. This is the most important point to consider. This is not as simple as it seems. For example, let’s consider how I would segment an organisation selling a graphics program. One company uses it to improve their event pictures, and another for creating marketing flyers. Although these sound very different, the toolset required is very similar. This is not a good way to differentiate. You can still run marketing campaigns to target these different groups, but the core product is the same. When segmenting, consider what sort of use cases your product supports and whose needs it best meets.

Maximise profit by meeting needs

By meeting the needs of the target Ideal Customer Profile (ICP), they will be willing to pay more. Note that this ignores affordability for now.

When determining if needs are currently being met, consider:

The percentage of customers with very poor solutions, such as manual workarounds. For example, when checking data quality, are they doing this manually?

The percentage of customers who have created their own solution. For example, have they built a reports engine in Excel?

The percentage of customers who use a direct competitor:

What do they like about this solution?

What problems are there with this solution?

How easy will it be for them to switch?

Market maturity stage

When a new superior type of solution is released, it typically creates a new market. There will be many new customers available willing to pay a premium due to the novelty and lack of competition. As more competitors join, the market matures and profitability reduces.

Mature markets

Entering mature markets can represent a big challenge. Products can be large and mature, leading to high entry costs. Additionally, established brands can have customer loyalty based on trust. Brand loyalty can give a significant competitive advantage. Here you can see three very similar products that are optimised. It will be very hard to enter this market:

Targeting niche customers

One strategy to avoid high levels of competition is to target niche customers. By focusing on needs that are poorly served in the market, you can create a differentiated product that is more likely to sell. Take, for example, the very mature digital camera market. It will be very difficult to establish a new compact camera. Here is where niche needs can help:

Example 1 - You could create a compact camera aimed at weddings where guests can capture memories of the event for the happy couple. With this very specific use case, you identify key weaknesses with current solutions and gain an advantage. In the case of current cameras, they have a basic design, are damaged by water, fragile and too expensive to leave with guests. This opens up the opportunity to create a new product. The product differentiates by being water and drop proof, with beautiful designs and a low price.

Example 2 - You could make a camera targeted at cave divers. With this very specific use case, you identify key weaknesses with current solutions and gain an advantage. In the case of current underwater cameras, you identify that they are bulky and prone to breaking when hitting rocks. This opens up the opportunity to create a new product. You should begin with user research to understand the issues with current solutions.

In the picture below, you can see that current solutions are not meeting these niche needs:

When determining if needs are currently being met, consider:

The percentage of customers with very poor solutions, such as manual workarounds. For example, when checking data quality are they doing this manually?

The percentage of customers who have created their own solution. For example, have they built a reports engine in Excel?

The percentage of customers who use a direct competitor:

What do they like about this solution?

What problems are there with this solution?

How easy will it be for them to switch?

Disruptive innovation

If you can disrupt an entire industry with a new innovation, you may target a broader customer group. Your marketing spend is likely to be lower as word of mouth and free press coverage promote your product. New types of product should solve a major problem with existing solutions. They can reset expectations of the ideal product. Consider the invention of the mobile phone. At the start, if your product is not mature, people may still select the old type of product. Mobile phones were very big and difficult to carry at the start. As they improved, they overtook, then replaced, old solutions, in this case, phone boxes.

Segmentation based on price

An important consideration when segmenting is the impact of price:

Price sensitivity

Some customers who see low value in a product will select basic products that are differentiated by low price. Any additional functionality is a benefit to them. They will still believe that the low-cost option is good enough to fulfil their basic need, rather than being of poor quality. They may still filter low-quality, low-price items out. For example, seeing many reviews that the product doesn’t work.

The opposite can be true, where a customer will pay a premium for a high-quality service. They are not very price-sensitive and simply want the best. This premium end of the market can be very profitable for the best products.

Affordability - Regardless of the value of your product to a customer, affordability can stop them from purchasing. By setting a high price, you limit their access. Where you have sufficient demand, consider:

Consider the size of the market if your product is expensive.

Consider starting with a low-cost product that you can expand. This is particularly relevant to software, where you can add additional features.

Our restrictions

Market entry restrictions can present challenges. When creating your ICP also consider:

Reach - Only being able to reach a section of the market.

Marketing capacity/budget.

Geographic location.

Service capacity - This will lead to tighter segmentation. For example, if support costs are very high, you may only go after high-value customers.

How many customers you can sell to.

How many customers you can support.

Regulations - Legal or regulatory requirements that can limit you.

Other - You may have other restrictions. It is critical to identify these when creating a new product.

Market size

You are now ready to evaluate your market size (market size tab). You may need to adjust your ICP if the market is too small.

ICP process

Step 1

With a product defined, you can now create your ICP using the canvas.

Step 2

Can we maximise success/profit with this ICP?

Customer needs - Does our product strongly match the ICP’s needs, and is it better than how they are solving this now?

Market maturity stage - Do we understand how crowded the market is, and can we compete?

Disruptive innovation - If we have this, can we target a broader customer group?

Price sensitivity and affordability - Is our product affordable to them, and will they buy this?

Our restrictions - Are we limited by any restrictions? Who we can reach, our support capacity, and regulatory requirements?

Market size - Is the market large enough?

Step 3

Refine the ICP when results come in (ICP refinement tab).

ICP Process Example

Our product - This trains footballers on how to score more penalties. It has a video training component providing information on specific goalkeeper weaknesses and different kicking techniques. This is followed up by personalised training based on an assessment.

We can now create an ICP.

ICP - Premium football clubs

Industry type - Football clubs

League - Premier League

Country - UK

% penalties missed - Over 20% of penalties missed in competitive matches

Using the ICP checklist:

Customer needs - Missing penalties can have significant financial implications. Lost competition and league revenue.

Market maturity stage - New market. Although penalties are taught, there is nothing this comprehensive.

Disruptive innovation - Our product is not disruptive. It is a competitor to various custom solutions.

Price sensitivity and affordability - The football clubs are not very price-sensitive due to the cost of losing.

Our restrictions - We only have two trainers, so this should be limited to one league in the UK for now.

Market size - The market is small (20 teams) but highly profitable. All current clubs have a penalty loss rate of over 20%. With success, we can expand into further leagues.