Competitor threat analyser canvas

Competitor analysis should affect your product, sales and marketing strategies. The competitor threat analyser is a canvas designed to structure this activity with a primary focus on feeding into your product strategy. Even if you don’t respond to every competitor, it is usually wise to monitor them. This means you are likely to have multiple canvases. The canvas can also be used when developing new products. Your win rate will not be relevant in this case. The canvas is primarily focused on software products. If you want to use this for physical products, please feel free to do so, although you may need to modify it.

Aspects like market share can be calculated, or if you already have a good enough idea, fill these in without detailed analysis. Each canvas section should add value and not be a pointless administrative task.

Having specific information about the reasons for winning, losing, and churn is the most important aspect of competitor analysis. This overrides all claims a competitor makes in their sales and marketing information.

Defeating the competition

Consider everything you gather in competitor analysis through the lens of winning. Collecting information on a competitor’s product and brand only to continually treat it as “interesting information” is a waste of time. In other words, your analysis should create a strategic impact.

Levels of competition

The diagram below shows how competition changes as the market matures.

In a new market, there will be many potential new customers available. When the market reaches maturity, there can be a lot of similar competition, with solutions growing and converging. Customers will typically switch between these solutions rather than try them for the first time. Eventually, a new type of solution will emerge, replacing the market, and the cycle will start again.

Start-ups and emerging solutions

Start-ups in new markets can sometimes ignore competitor analysis. There may be little competition, and they are focusing on establishing their new type of solution. This can be dangerous as the following risks can still impact them:

Current competition levels:

Customers are actively comparing you to another new competitor, and you are losing a lot of business to them.

Your differentiators are becoming much less effective as competitors copy them.

Competitor messaging strengthens as they respond to you, but you ignore them. Your messaging becomes generic and weak.

A competitor optimises their business model and reduces your ability to compete. For example, teaming up with a supplier to lower costs.

Future threat is high:

Your competitors are rapidly releasing new, important differentiators and threatening to take market share.

A competitor is receiving much industry recognition, and their brand strength is growing.

A competitor with a substitute solution is responding to your new solution type to stop you from replacing it. For example, you have a new AI-based accounts product, and they start to integrate AI into their solution.

Your competitor is forming an industry standard that puts you at a competitive disadvantage.

Competitor Threat Analyser Canvas

Feel free to recreate the canvas in a tool of your choice. Please attribute the author (Timothy Field), the source of the canvas (this webpage) and add the CreativeCommons BY-SA license

Important anti-patterns

Feature matching - The aim is not to achieve feature parity but to understand why this competitor wins. Some features may not be of interest to customers even if heavily marketed. This can be a hugely costly mistake. With a large product, this could result in years of work.

Copying their new work - Just because a competitor says they are releasing a new or superior feature does not mean you need to panic and respond. This is especially true of claimed differentiators, not all of these will be of value to customers. Start by talking internally about the threat (e.g. with your sales team). If sufficient, reach out to existing customers that you trust.

Not understanding their positioning - They may be differentiating on ease of use or price. For example, if on price, they will not produce a product that wows customers, they will continue to seek efficiencies and reduce prices. If you focus on features, you will miss their threat and could be undercut. When you understand their positioning, you may decide they aren’t worth competing with and focus on a different area of the market.

Not understanding their target customer - If their target customer is very different, for example, they have a simple use case and want a low-cost product. In this case, your offering will not be attractive. If you want to compete, you need to change your Ideal Customer Profile (ICP). You should only do this if you believe this will maximise success. Otherwise, you should let the sales go. View any that land as a bonus. If your ICP is very different, you may not want to respond to this competitor.

The canvas as a strategic input

You should not always respond to competitors. The Strategic Direction stage of the Commercial Product Framework explains how to prioritise and react. Each canvas will feed into its competitor process.

Canvas sections

The detailed guide below explains how to use each canvas section.

Market position

How a competitor describes itself and its strengths is not always the same as the customer’s opinion. Ultimately, this will be reflected in the organisation’s position in the market. Fundamentally, the organisation’s health can be judged by its size and whether it is growing, stagnant, or losing business.

Product Positioning

This considers how the organisation wants its product to be viewed. Done well means they are demonstrating to customers how they meet their needs.

With many products, there will be a lot of basic information about how they work. This is particularly true when customers aren’t knowledgeable. With product positioning, you should focus on how competitors promote their differentiators, such as customer service, quality, price, and ease of use. If they consider themselves your direct competitor, they may call out the differences between your product and theirs.

The picture above considers two types of differentiators. You should record their claimed differentiators, what the competitor says it is best at. Remember, just because they have claimed it doesn’t mean it is true.

There are several sources where you can deduce their product positioning, including their website, marketing and any sales materials you can gather. Here are some useful questions:

Differentiators - Do they explicitly state differentiators?

Tagline - A tagline is a short summary of their offering. This can usually be found at the top of their website homepage.

Price - Do they push a low-cost or high-cost version(s) with additional differentiators?

Customer reviews - Do they push selected customer reviews that highlight their strengths?

Target customer

A product should have a target customer group that it is focussed on. A product that goes too wide will find its functionality bloating and messaging becoming confused. Determining their target customer group helps you decide if they are a direct competitor. There can be many clues as to their customer type:

Naming targets - They talk about the type of customers they target. For example, they explicitly mention targeting scale-ups.

Current customers - They have information about the current customers they have sold to. Look out for ones that promote the product. This could be in promotional material such as videos, case studies or talking at events.

Functionality - Their product’s functionality clearly reflects a customer type. For example, they have a simple use case that will appeal to a beginner.

Sales - In B2B sales, where they often pitch to the same customers as you or attempt to take your existing business.

Social media - They use social media platforms or messaging that appeals to a particular customer type.

Product recognition

The better known the product is, the higher the likelihood of it competing with you. Pay attention to organisations that are spending a lot of time and effort on marketing and advertising.

Measuring product recognition

Surveys

Here are a couple of simple surveys:

Customer Survey 1 - Aided product awareness

Run a survey with your target customer group.

Show multiple products, including yours.

Record the percentage of those who recognise your competitors.

Customer Survey 2 - Unaided product awareness

Run a survey with your target customer group.

Ask each customer to name products they know of in your product category.

Record the percentage of those who name your competitor.

Website traffic

Use website tracking tools to review how much traffic is coming to their website. These can give you a lot of other competitive insights such as which keywords they rank highly on (SEO).

Market share

Organisations with a large market share can represent a significant threat. They may have a lot of resources available to enable them to cut prices or build new differentiators.

Market share calculation

The total industry sales can be determined through public bodies such as the CBI and business whitepapers. It can be calculated using total revenue or non-financial metrics like number of customers or units sold. Select a period of time, such as a financial year, and run the calculation below:

Market share = company sales / total industry sales * 100

For example:

Total industry sales = £10 million

Company sales = £2 million

20% Market share = £2m company sales / £10m total industry sales * 100

For more detailed information see this article from Indeed.

Growth

A competitor with rapid growth indicates its strategy is succeeding. Pay particular attention to why new competitors are doing so well. You can use the market share calculator over time to identify trends.

Customer channels

Customer insights from these channels can create a view of a product that can contribute to your marketing and product strategy.

Buyer reviews

These are the official channels on which customers leave reviews.

Where the product is discussed

Competitors reach their customers

Identify the channels where competitors reach their customers. This includes:

Sales - Driving awareness of their brand and products.

Loyalty - Creating a relationship with existing customers to retain them.

Identify where your competitor’s target customer group are in both digital and non-digital channels. For non-digital, this may include conferences or specialist meet-ups.

You should monitor these channels for product feedback and future direction.

Customers talk to each other

Customers may offer each other advice, criticise or praise a competitor’s product. This may be outside of an organisation’s control and offer unfiltered insights.

Pricing

In this section, you should record your competitor’s pricing. Successful pricing will directly relate to a customer’s perception of value. Customers will not have the same expectations of a high-cost product versus a low-cost one. Pricing is a value lever. In other words, it can be used as a differentiator to drive sales. You will use this pricing information to assess the value of their offering in the win/loss analysis sections.

Make a note if they are using penetration or skim pricing strategies as per the information below.

Penetration pricing

A penetration pricing strategy can be used with a new product to gain market share. Prices may rise when they have gained enough market share. If you and existing competitors start reacting to penetration prices, you will see a race to the bottom where profits significantly shrink. If you have an established product, avoid reacting to a new product:

Until you see a significant, sustained drop in sales.

If the company is operating at a loss, it may not be able to continue for long.

Skim pricing

This strategy can be used with a new type of product in high demand with little to no competition. If your competitor has a new product that is much better than your own, it is strongly recommended that you react to it. For example, Blockbuster didn’t react quickly enough when streaming services like Netflix began to replace it. Your competitor will be able to maintain skim pricing until you respond. The competitor may make fewer sales at this point due to the high price.

Future threats

Organisations typically want to excite new customers with the promise of increased value.

Identifying development in progress:

Do they have public information, such as a product roadmap, available?

Do they talk about new work in the sales demos and webinars?

Identifying key messaging:

Are they changing their product positioning?

Are they targeting a new customer group?

What subjects or trends does their new public content cover?

Are they marketing future functionality

Are they promoting themselves as thought leaders?

Are they framing themselves as better in some aspects or directly comparing themselves to you?

Determining threat level

You should only record significant threats. The overall threat level score (1 = low, 5 = very high) is impacted by the following:

Development in progress

Development in progress can represent a high threat as new features can become differentiators. In the same way you would test your own features, you can do this with your competitors:

Take a feature and determine what problem it is solving for customers.

Confirm the problem size with existing customers.

Create a lightweight visual mock-up and test the idea with your sales team and some trusted customers.

This will give you some evidence of its likely future success.

Key messaging

Assess the messages against those you think will bring a genuine competitive advantage. For example:

You are losing business due to a competitor’s feature, and they have just started to promote it.

They are about to target your high-value customers.

Product growth

A competitor with significant product growth (Market position section of the canvas) should be considered a future threat. It is highly advisable to work out why they are winning.

Competitor Winning

This section covers:

Sales loss - Key reasons why customers selected this competitor.

Churn - Key reasons why customers left you and joined this competitor.

The customer’s overall decision to purchase from a competitor may be due to a group of reasons. There can be factors outside of the product itself, such as trust in a salesperson. Metrics are optional but recommended, especially in a crowded market or where you are seeing high rates of churn and sales loss.

Competitor Sales Wins

% of sales lost to this competitor

When you lose a sale, it is important to know who it was to. We don’t want to consider customers who didn’t buy. This allows you to judge when to react. In this metric, we want to know the % of sales lost to this competitor. Below is a picture that helps demonstrate this:

This calculation will give you the loss rate percentage:

In a direct sales process, it can be much easier to calculate your loss rate. If you are not in one, ask resellers and partners for figures. When you can’t gather exact figures, use the following sources and look for trends over time:

Conduct market share analysis.

Look at the number of reviews, focusing on the number of new ones and what people are saying.

Interview customers to gain purchase reasons.

You will have to make a judgment call over their current threat level.

Key reasons for them winning

Capture their key strengths that helped them win. It is important to separate out the marketing from what is really resonating with customers.

Competitor Churn Wins (from us)

You may get a great deal of warning that a customer is going to churn. The canvas in the Strategic Direction stage provides Net Promoter Score (NPS) and Customer Health Score (CHS) metrics to expose overall risk. If a customer has churned, make sure you capture the key reasons why as soon as they leave. You are looking for common themes.

When a customer churns, they will have a number of options. They may churn to a competitor, to an old custom solution or even stop using a product altogether. In this case, we want to know how many are churning to this specific competitor:

This calculation will give you the loss rate percentage for a single competitor:

Problems with our offering

For example, many customers have churned due to service quality.

Competitor benefits that convinced them to switch

Not all reasons for switching are down to problems. You may have a very good product and service, but be missing functionality.

Competitor Losing

This section covers:

Sale loss reasons (not churn) - Why a customer did not select this competitor, not including those who churned to you. This can happen when:

You won the sale.

You both lost the sale.

The customer didn’t buy at all.

Churn to us - Why customers left this competitor and joined you.

Competitor sales loss

Key reasons for them losing

This section captures why a customer has not selected this competitor. You most likely won’t have direct access to all these people and will have to make a judgment call on what mattered most to them.

Gathering information with customer reviews

You can use the customer channels tab to identify where to find this information.

Gathering information with sentiment analysis

To gather information, consider running sentiment analysis. Sentiment analysis looks at the overall tone of customers. There are automated tools that can help:

Track positivity - Give percentages of positive, neutral and negative comments.

Gain customer insight - Understanding customers’ opinions gives you insight into them. For example, you find a lot of complaints that part of their software is hard to use.

Gathering information with a sales team

Capture information where you and a competitor are both in a sales process, and the competitor loses.

Churn to us

The insights you can gain directly from your customers about their purchase decisions are the most valuable information you can gather. Not only is this useful for improving your product strategy, but it will also feed into sales and marketing, where you can promote these reasons. You should gather this information as closely as possible to the point of purchase. If you leave it too long, the customer will tell you what they think about the product, not their pre-purchase impressions.

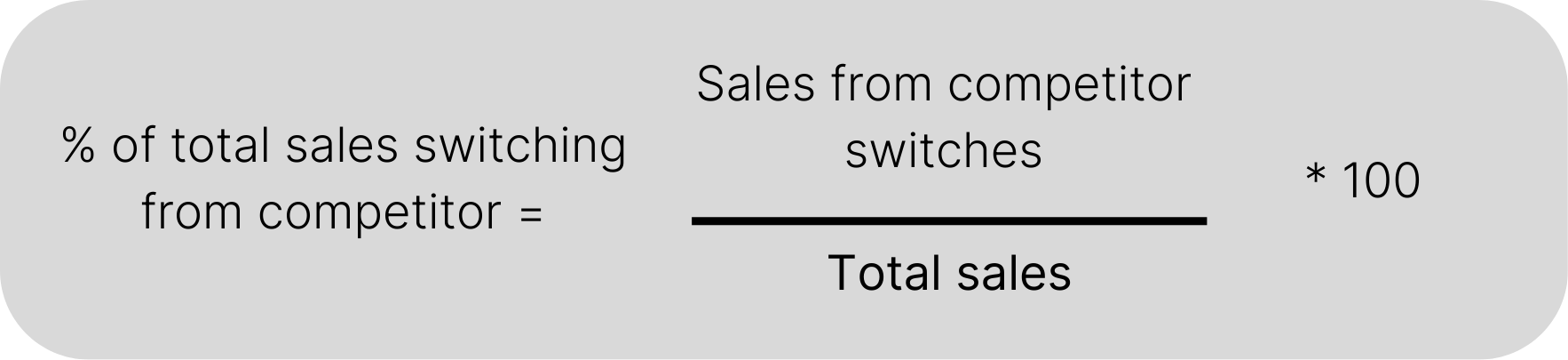

% of total sales switching from competitor

This is the percentage of customers joining from this competitor. The diagram shows a breakdown of all the customers who joined. Some customers will be new to your type of solution. For example, if they typically don’t water a garden and purchase their first hose from you. Consider competitors 1 and 3 here, you have a particularly high win rate against them.

This calculation will give you the switching rate percentage:

Key reasons for churning to us

It can be much easier to gather insights from your own customers. You should ask the customer the following question: “What big problems did you find with the competitor’s offering that made you want to switch?”. This tells you the weaknesses you can exploit.